Dave Baiocchi

Dave Baiocchi MHEDA Rental Strategies 1

I am writing this on an airplane, returning from the MHEDA Rental and Used Equipment Conference held in October of 2019. I was one of four speakers at the conference, and shared my thoughts about best practices and strategies necessary to build a robust dealer rental offering. The meeting was set up to allow for round-table breakout sessions after each speaker presentation. This allowed the dealers to share their own experiences and ideas about the subject matter.

Although the information provided by the speakers was relevant and useful, some of the most exciting ideas were shared across the table at the breakout sessions. This once again proves the theorem that “none of us are as smart as all of us”. The ideas that move the needle for the dealership aren’t always derived from a power point slide. The conference was so full of great ideas that I wanted to share the highlights of the material presented. Over the next few issues I will cover the topics presented as well as the dealer insights I garnered from the roundtable sessions.

Rental Strategies

Rate setting

Common practice in rental departments is to use the same formula we have used for decades to calculate rates. Most dealers know that the goal is to create an average monthly rental income stream of 4%-6% of the acquisition price of the equipment. This assumes that the equipment will be working in conditions that are clean, dry, and temperate. This also assumes a usage profile of not more than 160 hours a month. Taking all of this into account, over its rental life, the equipment should provide an ROI of about 40%.

As I said, the 4%-6% calculation is a formula that has been used for decades, not only in the material handling business, but many other capital equipment industries. It’s important to remember that although the calculation has not changed, the equipment has. Today’s machinery is engineered and manufactured to substantially extend what once was thought to be a 5-year life cycle. We all know lease programs that regularly extend the term to 72 or even 84 months. This provides a longer rental life for new assets, and can provide flexibility and profitability when considering rates.

Creating consistent revenue – Multi Season Rental

Dealers routinely struggle with seasonal requirements and being able to create the income stream necessary to commit to purchasing and adequate supply of short-term rental units. It can be a delicate dance to invest in rental inventory when your best customers only have a 12-week harvest season.

One strategy to meet customer demands while also creating a prudent income stream, is to “link” rental contracts (and new rental inventory) to individual rental customers. Especially in cases where the rental demand is predictable, this practice allows you to target selected users, offering added value for a multi-year rental agreement.

This method should pair two or three rental customers with “non-overlapping”, predictable rental demands. An example:

- Customer one is a cherry producer with a harvest season from early May through June

- Customer two farms almonds that are harvested in from Mid-July through September

- Customer three is a raisin packer who processes his crop in October and November.

In this scenario, I can create six to nine months of predictable rental income per year. This income is adequate to properly depreciate a new rental asset. Seek to secure commitments for five rental “seasons” from each customer. Allow flexibility within the program (no minimum billing). If a particular weather event ruins a crop, simply add another season to the end of the commitment. If you can pre-capture this much expected income, any supplemental rent collected from December through April will only add to your profitability.

This practice may also work with industrial customers that rent equipment for annual inventories, plant maintenance or other periodic events. Not every dealer has the marketplace to drive this kind of repeatable income, but if we look closely enough, we may find some patterns that would allow for this multi-year strategy to be employed.

Rental Purchase Options – Using sliding scales

My observations when visiting with dealers is that when it comes to rental practices, dealer subscribe to practices that fall between these two policies:

- Rental units are for rent – not for sale.

- Everything is for sale – Rental money collected is always viewed as “money on deposit” against the sale of the unit.

Your dealership my fall somewhere between these two positions, but notwithstanding your current policy, allowing customers to gain equity in rented equipment can be a tool we can use to grow our marketplace, and provide added value to customers.

Most dealers have some sort of Rental Purchase Option (RPO) program that allows customers to apply a portion of the rent toward the purchase of the equipment. These programs are normally limited to short timeframes and predetermined pricing. RPO’s are routinely set up “in advance”, with the equipment pricing, rental rate, and applicable rent percentage laid out prior to equipment delivery.

Some dealers however have expanded their RPO programs to offer this kind of program on almost every rental contract of 1 month or more. When this practice is used properly, it moves good, serviceable, used equipment to the field using the rental platform as a tool to grow sales. Our brand of equipment, owned by the customer, consuming parts and service at retail rates. Isn’t this what we want? Why are we not exploiting the rental platform to do this?

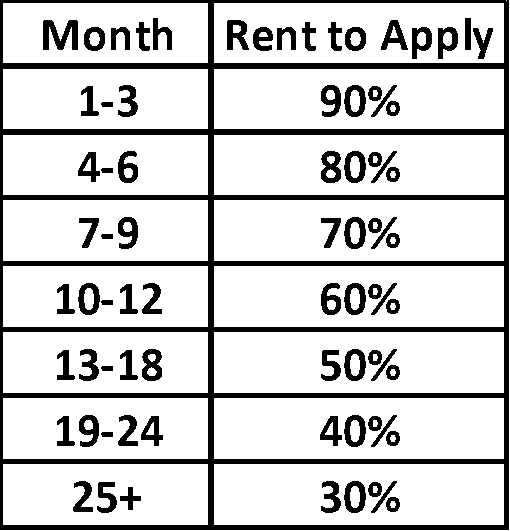

Dealers that are successful in expanding RPO normally have ways to motivate their customers to “convert early” in the rental process. Using sliding scales is requisite to this process. This is a scale that we used in our dealership:

Every month, the salesperson would contact the customer and attempt to close the conversion by highlighting the fact that the rental applicability toward the sale price was diminishing. In effect, this practice allowed customers to “build” a down payment on equipment that they never expected to have an opportunity to purchase.

In addition to the sliding scale, dealers also have to have a way to quickly calculate selling prices on rental assets, consistent with their age, condition, hours and accumulated depreciation. This can be a moving target, but with the business systems we all use, an algorithmic formula should be attainable.

Leveraging telematics – Service scheduling/Billing

All product-based businesses are attempting to find way to leverage the “Internet of Things” (IOT). For us, this has pushed the term “telematics” into our daily vocabulary. If you are uninitiated, telematics is the word we use for a device that wirelessly transmits equipment data to the customer, the dealer, or both parties. These devices can use cellular broadcast technology, but more commonly they will use the Wi-Fi available at the customers place of business. Telematics reports are wide and varied, and can monitor and report the following functions

- Unit hours

- Unit error codes

- Unit impacts

- Over Temperature data

- Battery discharge data

- Operator data

These devices are not yet standard equipment from most of the OEM’s, but I have a sneaking suspicion that it won’t be long before IOT devices and associated reporting will be the next value point to be exploited. Data is everything! Using this data to help a customer make fleet decisions, set service intervals and rotate assets can help to redefine your value proposition.

Using telematics for care of the rental fleet should be no different. How many times have you scheduled a PM for a rental unit at a customer location, and found it had only accumulated less than 100 hours? How much customer damage has gone unbilled because an accidental impact could not be proven? What a waste! This is all now preventable by investing in IOT devices and USING the data to drive rental policy and expense decisions.

This technology will also help dealers expand their flexibility. “Billing by the hour” is now effectively within our grasp. How many customers have demanded this, and how much trouble was it to dispatch personnel to take hour meter readings? These are the types of services and value points that customers are yearning for. Telematics helps us get there.

Next month I will touch on a few more ideas to grow and leverage our rental offerings. Wishing all of you a happy and prosperous New Year!

Dave Baiocchi is the president of Resonant Dealer Services LLC. He has spent 37 years in the equipment business as a sales manager, aftermarket director and dealer principal. Dave now consults with dealerships nationwide to establish and enhance best practices, especially in the area of aftermarket development and performance. E-mail [email protected] to contact Dave.