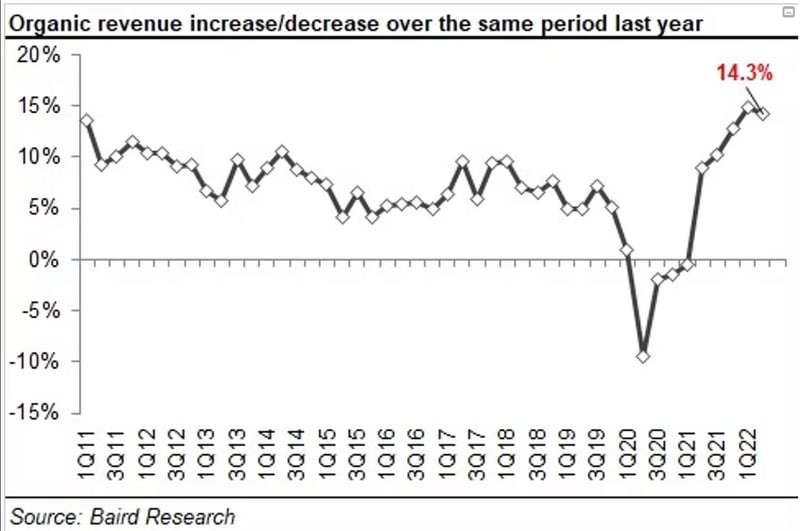

Rental Revenue jumps 14.3 percent in Q2, Baird/RER Survey respondents say

Sixty-one percent of respondents said second-quarter revenue exceeded expectations, while 34 percent reported revenue in line with their initial expectations.

Average rental revenue increased 14.3 percent year over year in the second quarter, according to respondents to the 2Q Baird/RER rental equipment industry survey. The increase was mostly in line with last quarter’s 14.8-percent hike. This marks the fourth consecutive quarter of double-digit growth. Sixty-one percent of respondents said second-quarter revenue exceeded expectations, while 34 percent reported revenue in line with their initial expectations.

Overall commentary on rental revenue was more cautious compared to recent surveys.

“Our web inquiries have seen a dramatic decrease over the last two weeks, so we think the interest rate hikes have slowed some markets on new equipment purchases already,” said one respondent. “The next rate hike in July may tip the scales and have us revisit our stock sales inventory forecasting for 2023.”

“Unless energy costs stabilize, inflation will persist,” said another.

“Workforce is a much more severe problem to the growth of the industry and will significantly negatively impact value of infrastructure bill,” added another respondent.

“Bit of a slowdown, not sure if it is weather or slowdowns caused by labor shortages,” said a third respondent.

Another respondent said this spring was slower than 2021, and that his company’s revenue increase is from rate and price increases rather than organic growth.

Fleet utilization was 62.3 percent for the second quarter, up from 61.8 percent in the first quarter and a full percentage point from the second quarter of 2021 when it was 61.3 percent. The utilization was better for earthmoving equipment than it was for access machinery. Earthmoving utilization increased to 65 percent in the second quarter compared to 63.5 percent in the second quarter of 2021. However, access utilization declined year over year from 64.5 percent a year ago to 62.1 percent this year. Small iron improved from 52.2 percent a year ago to 53.3 percent this year.

Average rental rates were up 4.5 percent year over year, basically the same as last quarter when they rose 4.4 percent. Improvement in rental demand helped provide pricing flexibility. There was, relatively speaking, little commentary regarding rental rate pressure from larger competitors.

Rental rates still to rise in 2022

Respondents said they expect rental rates to be up 5 percent for the year, which is similar to last quarter’s forecast when respondents predicted a 5.1 percent for the year.

However, rental companies did express concerns.

“Competitors are not raising their rental rates in line with the price increases we are having to pay for new machines,” said one.

“Expenses are superseding income increases,” added another. “The cost of doing business is rising dramatically, and rental rates do not seem to be keeping up with the pace.”

Respondents are expecting a 9.7-percent revenue hike in 3Q22 with 27 percent expecting a 1 to 5 percent increase year over year. 25 percent expected 5 to 10 percent and 24 percent expected a 10 to 15 percent leap.

Respondents still expect an 11.7 percent increase in 2022, up from an expected 9.2 percent increase last quarter. Steady demand from end markets is still expected to continue but is partially offset by equipment and labor shortages. However, respondent optimism is not as high for 2023.

“An economic slowdown in 2023 seems more likely all the time,” said one. “A modest slowdown would seem to be an appropriate tonic that might improve the labor market, manufacturing lead times, and improve supply chain restraints.”

“With all the uncertainty in the economy we have major concerns for 2023,” said another. “Extremely busy today but not sure if things will slow down creating a glut of equipment.”

Growth in the cost of new equipment continues to be high. Respondents placed the increase at 6.6 percent, down a bit from the previous two quarters, which were increases of 7.2 percent and 6.8 percent. OEMs are still aggressively raising prices to offset their own costs, including elevated steel prices. The May Construction Machinery Manufacturing PPI hit a record high (back to 2004) of 11.4 percent year over year. Extended lead times, or uncertainty over lead times, remain a major concern because of the difficulty of fleet planning.

Fleet sizes still increasing

Respondents’ average fleet size in a number of units increased 6.6 percent year over year in 2Q22, which was the strongest growth since 1Q18. Respondents expect to increase fleet purchases by 9.7 percent year over year compared to 8.5 percent last quarter.

Access equipment spending is expected to rise 7.5 percent over the next six months, with earthmoving expected to up 10.2 percent, small iron at 4.6 percent, and “other” 20.3 percent.

Thirty-nine percent of respondents expect labor costs to increase 5 to 10 percent in 2022, versus 52 percent last quarter, while 35 percent expect labor costs to top 10 percent.

Respondents also expressed concern regarding higher interest rates impacting the housing market and equipment financing rates, with 28 percent expecting a potential residential construction slowdown. With six months remaining in 2022, respondents expect 6.3 percent revenue growth in 2023, compared to 11.7 percent growth in 2022, and 6 percent fleet spending growth compared to 9.7 percent growth in the second half of 2022.