Baird/RER survey suggests Rental Revenue to dip

Equipment rental activity started to slow toward the end of the first quarter of 2020, impacted by COVID-19 related disruptions and a slowdown in oil and gas activity, according to the 1Q Baird/RER equipment rental survey.

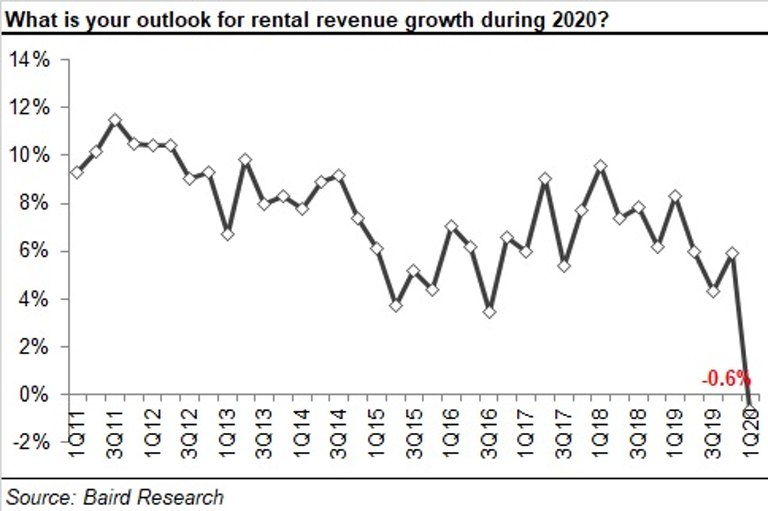

Revenue is expected to decline slightly in 2020, the survey shows. The previous low forward revenue projection was in the third quarter of 2016 when respondents predicted a 3.5 percent revenue increase.

Revenue is expected to decline slightly in 2020, the survey shows. The previous low forward revenue projection was in the third quarter of 2016 when respondents predicted a 3.5 percent revenue increase.

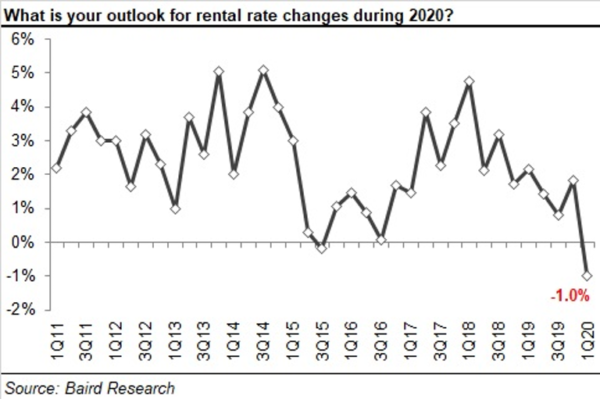

Average rental rates were down 0.2 percent year over year, similar to the second quarter of 2015 through the first quarter of 2017 period. Rate pressure was originating from lower demand due to COVID-19 and plunging oil prices.

Rates expected to be slightly lower in 2020 vs. 2019. Rental rates are expected to decline 1.0 percent in 2020, the first time the survey’s forward expectations have been negative year over year.

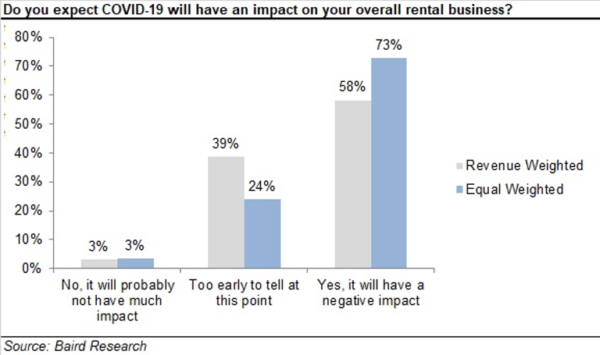

The majority of respondents expect COVID-19 to have a negative impact on the rental business. 58 percent of respondents (weighted by revenue) expect COVID-19 to have a negative impact on the overall rental business (the vast majority of remaining respondents believe it’s too early to tell). Equal weighted, 73 percent of respondents expect a negative impact (i.e., smaller respondents more likely to expect a negative impact).

The majority of respondents expect COVID-19 to have a negative impact on the rental business. 58 percent of respondents (weighted by revenue) expect COVID-19 to have a negative impact on the overall rental business (the vast majority of remaining respondents believe it’s too early to tell). Equal weighted, 73 percent of respondents expect a negative impact (i.e., smaller respondents more likely to expect a negative impact).