June 2022 Logistics Manager’s Index Report®

- LMI® at 65.0

- Growth is INCREASING AT AN INCREASING RATE for Inventory Levels

- Growth is INCREASING AT A DECREASING RATE for Inventory Costs, Warehousing Utilization, Warehousing Prices, Transportation Capacity, Transportation Utilization, and Transportation Prices Warehousing Capacity is CONTRACTING

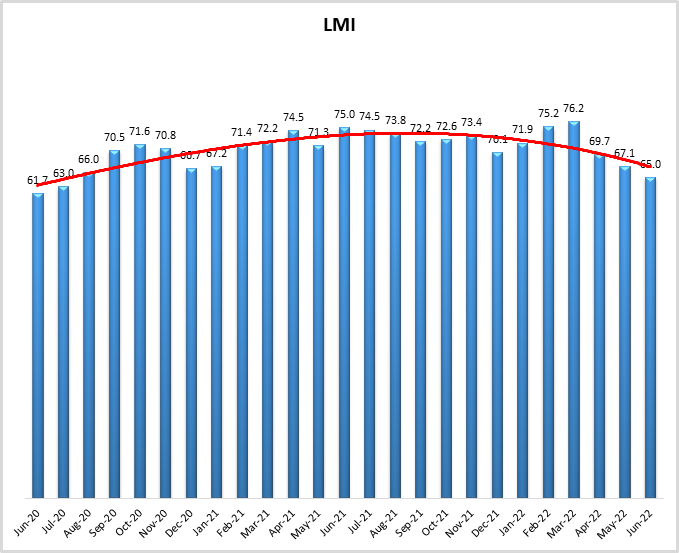

The Logistics Managers’ Index reads in at 65.0 in June, down 2.1 points from the May reading and slightly below the all-time average of 65.3. This is the first time since July 2020 that it has been below the all-time average. While this does still represent a healthy rate of expansion in the logistics industry, it is a far cry from three months ago when the index hit an all-time high reading of 76.2. The steep decline is reflective of what we have seen in the overall economy in the last three months, moving from the record-setting expansion of the last 18 months to the greatly subdued level of growth observed throughout Q2. We are also seeing a different type of growth now than we were previously. Up until 2022, we saw high demand for transportation and warehousing and difficulty building up inventories, June’s report is the opposite. Inventory Costs lead the way at 83.8, and Inventory Levels are up (+2.5) to 71.8, marking the fifth time in six months that metric has come in over 70.0 – something that had only happened twice before 2022. Meanwhile, Transportation Price is down 61.3, below the all-time average of 74.0, and more importantly, slightly below Transportation Capacity’s reading of 61.7. when these two lines invert, it often means a serious economic shift has taken place. This is the first time Transportation Capacity has been above Transportation Price since the locked down days of April 2020. Warehousing metrics remain elevated, although it is worth noting that Warehousing Prices are down (-9.1) to 78.4.

Researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno, and in conjunction with the Council of Supply Chain Management Professionals (CSCMP) issued this report today.

Results Overview

The LMI score is a combination of eight unique components that make up the logistics industry, including inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in June 2022. Overall, the LMI is down (-2.1) from May’s reading of 67.1. The slowdown in the rate of expansion is the product of the continued slowdown in the transportation market. However, the overall logistics industry continues to expand, driven primarily by high levels of inventory growth and the associated costs. While Transportation Capacity has now expanded for two consecutive months (although at a slower pace in June than in May), Warehousing Capacity continues to contract, the slight expansion we observed in the back half of May did not translate to further growth in June.

In a story that we have been tracking over the last few reports, no agreement was reached between the Pacific Maritime Association (PMA) and the International Longshore and Warehousing Union (ILWU) before the July 1st deadline, meaning the current contract between the two parties has expired. Over 150 industry groups pushed President Biden to encourage a quick resolution – seemingly to no avail (although Biden did meet with both parties in mid-June). Although both parties have stated that business will continue despite the absence of a new deal, an eight-day strike occur at the previous impasse in 2015. Shippers will attempt to route cargo to other entrances, but East Coast ports may already be at capacity[1]. The biggest stopping points with the negotiations are pay and the push towards greater levels of automation. Workers are eager for higher pay given the increased volume of the last few years, and ports are interested in greater automation to shield them from the types of labor shocks they saw over the same period[2]. Interestingly, labor strikes are already taking place at German and Dutch ports, slowing down the flow of products like automobiles and furniture. Analysts warn that even if strikes were to let up, it would still take months to work through the backlog. Globally, only 30-40% of containers are currently being delivered on time[3], and it seems likely that prolonged strikes will cause this number to drop even lower.

As has been the case for the last two years, the problems extend beyond the ports and further down the supply chain. For instance, some firms have reported waiting weeks for intermodal rail to ship containers out of the Southern California ports. Much like we saw in 2021, the backups extend to the switching hubs in Chicago (where BNSF containers are experiencing 20% higher dwell times year-over-year). In another repeat of last year, BNSF has announced it will be limiting new orders to get this backlog under control – a move that will back goods up at the port even longer. This demonstrates the limited capacity of intermodal to cover for increasingly expensive trucking. 29,000 boxes are waiting to get picked up from the Port of Los Angeles – triple the normal amount and further evidence that capacity is still not where it needs to be to get supply chains back to normal levels of operation[4]. Despite slowing economic growth the Ports of Los Angeles and Long Beach both reported their third-busiest month ever in May 2022[5], with the former predicting increased year-over-year volume in mid-July as back-to-school inventories flow in[6]. The Port of Oakland is following in the footsteps of its Southern California counterparts, reducing the “free” time that containers may sit at its terminals from seven days to four days in an attempt to clear congestion[7]. The federal government is also attempting to address congestion due to stagnant containers, introducing a new regulation that will make it more difficult for shipping companies to refuse exports – a practice that has become more common over the last two years as carriers attempt to turn around more quickly to focus on more lucrative loads from Asia[8].

This congestion continues to play a role in the slow movement of inventories. JIT management has still not really become possible for many industries because the set of assumptions that JIT requires (e.g. quick, cheap, reliable transportation, and sufficient storage space) have not come back. These issues have led our Inventory Levels metric to continue rising (+2.5), reading in at 71.8 – the fifth reading over 70.0 in the first six months of 2022 (there had only been two readings over 70.0 from 2016-2021). High levels of inventory are pervasive across multiple levels of the supply chain. U.S. wholesale inventories were up 2% in May to 880.6 billion – 25% higher than this time a year ago[9]. The situation is not much better downstream, consumers brought 6% fewer retail items through Q1 of 2022 relative to 2021. Together, these are key factors in the high level of uncertainty that many retailers currently facing the possibility of bankruptcy[10].

Perhaps reflecting the overwhelmed state of retail and whole inventories, a survey of factories from around the world recently reported a slowdown in new orders. Interestingly, while Chinese manufacturing actually picked up in June as lockdowns eased, exports from South Korea (which are largely centered around electronics) and Vietnam slowed down. The slowdown in South Korea aligns with a general slowdown in the demand for consumer electronics as more workers go back to the office and inflation takes a bit out of nonessential spending. It will be interesting to continue to monitor electronics manufacturing, as a significant slowdown could free up some of the semiconductor supply that has been a bottleneck for so many firms (e.g. GM who failed to deliver 95,000 vehicles in Q2 due to a shortage of chips[11],[12]. Even Toyota, which was so successful in 2021 due to a stockpile of components is now struggling, reporting sales 19% lower than the last year11. This mix of work-in-process (WIP) inventory and overstocks has led to continued rapid growth in Inventory Costs; while the rate of growth has slowed (-4.3) still comes in at 83.8, the highest of any of our metrics in June. It is important to note that spending is not falling everywhere, orders for durable goods (e.g. trucks, homes, computers, etc.) were up 0.7% in May (although overall retail sales were down). Military and business orders remain strong, leading analysts to observe that economy is “bending rather than breaking”[13]. Overall spending increases slowed to only 0.2% growth, fueling concerns that spending on consumer goods is slowing dramatically[14].

As always, high levels of inventory have a sharp impact on warehousing metrics. Warehousing Capacity was down (-4.9) contracting at a rate of 41.0 – its 22nd consecutive month of contraction. A record level of warehousing space was ordered pre-slowdown, 579.8 million square feet were absorbed in 2021, with 519.9 under construction as of February[15]. And while there has been some slowing, the demand still remains strong for warehousing space – case in point Warehousing Prices have slowed (-9.1), but still read in at a very robust 78.4. This is partially due to the sectors that have been protected from inflation-related demand destruction. Yes, consumer spending on elastic goods like apparel or electronics has slowed, but 3.3 million square feet of cold storage warehouse space was under construction in the second quarter – up a staggering 100% from the total built-in 2019. Cold storage items are largely inelastic, people cannot just stop buying groceries, and are less prone to inflation-related slowdowns[16]. Warehousing Utilization reflects this (particularly downstream) still growing at a rate of 69.1 as firms struggle to find space for all of this inventory. Warehousing capacity comes online much slower than transportation capacity, and it seems as though storage was not as overbuilt during the last two years. When combined with the continued strength of eCommerce and the high levels of inventory, we are not seeing the dramatic price drops for warehousing that we are seeing with transportation. However, one similarity we are observing between the two sectors is a trend towards consolidation as the larger players with big stockpiles of cash are beginning to absorb the smaller firms who are not as equipped to handle any type of slowdown[17].

We do continue to see softness in transportation markets. Transportation Capacity is down (-2.9) to 61.7. It is interesting that the rate of expansion has begun to slow after only two periods of growth. During the 2019 slowdown, we observed multiple capacity readings in the mid to high 60’s, with a high reading of 72.0 in April of 2019. July is often a slow time for the trucking industry, but as mentioned above, imports will continue to come in, and we would expect an increase in freight movement as we get into August. We are also a long way from 2019-type readings in Transportation Prices. Transportation Prices are down (-3.9) to 61.3 in June. While this is the lowest this metric has been in two years, it is nowhere close to the streak of six consecutive months of contraction we observed from May to November of 2019. The continued growth is partially due to the difference between spot and contract rates. In the last week of June, the spread between truckload contract and spot rates reached 73 cents per mile and even greater discrepancy than what we observed in the early days of the pandemic. It is worth remembering that this dip in spot rates (20% since January) comes with a 90% increase in the price of diesel, pushing spot margins to a somewhat bleak place. Contract margins are up 50% from the summer of 2020, so it is not the end of the world for large carriers with stockpiles of cash and the ability to buy diesel in bulk – retail diesel prices are currently $1.28 higher per gallon than wholesale averages[18] – it remains to be seen though how much longer smaller, spot-dependent carriers can hang on, particularly those who cannot[19]. Recent movements in Transportation Utilization are similar to Transportation Prices. Transportation Utilization is down (-5.9) to 58.4 the first time that number has been below 60.0 since May of 2020, but still well above the readings in the high 40’s and low 50’s we observed in 2019.

Underlying this recent downshift is inflation – particularly the inflation-related to spiking fuel prices. The U.S. consumer price index was up 6.3% in May – equal to the increase in April and slightly down from the 6.6% increase in March[20]. Interestingly, A new tool from the San Francisco Fed shows that the bulk of inflation has come from supply-driven issues (e.g. fuel), not demand-driven shortages[21]. Essentially, the lack of supply of inelastic goods like fuel and supply are the primary culprits for increased inflation, which casts some dispersions on the Fed’s ability to corral inflation through the destruction of demand. Consumers have already shifted away from elastic goods like apparel or electronics and inflation is still increasing. Indeed, Chairman Powell stated in a recent congressional hearing that he does not believe that increased interest rates will materially impact the price of non-elastic goods such as gas or food[22]. It is impossible to predict the future, but it seems unlikely that increased interest rates will do much to lower the price of fuel when the underlying issue is that with Russian oil off the table, there is simply not enough of it to meet demand. In what may be an acknowledgment of this, the Biden administration seemed to signal in a recent development plan that they would be open to further drilling in the Gulf of Mexico as a step to combat high gas prices[23]. The Biden administration is also pushing for a fuel tax holiday during the summer months, but logistics industry professionals are skeptical of this, noting that the savings of 18.4 and 24.4 cent savings for gasoline and diesel respectively pale in comparison to the increases that we have seen this year, and could also remove $10 billion of funding from the recently-passed infrastructure bill[24].

Observing the interplay between different aspects of logistics costs can help to understand what is happening, and what might yet happen, in both the logistics industry and the overall economy. The chart below tracks the movements in the LMI’s three cost metrics, Inventory Costs (green line), Warehousing Prices (blue line), and Transportation Prices (purple line). It is interesting how similar the current dynamics between these metrics are to those from three years ago. As mentioned above, there was a freight recession in June of 2019. The U.S.-China trade war had stymied industrial and B2B freight and while the consumer economy remained hot, available capacity had been overbuilt. This led to contracting Transportation Prices and a high number of fleet closures over the next few quarters. Ironically, COVID-19 was the thing that ended up jumpstarting transportation markets out of their malaise. All three cost metrics reached into the high 80’s and low 90’s during last summer’s stimulus-fueled congestion and was continuing on a similar path until March of this year when the Russian invasion of Ukraine destabilized diesel prices and kicked off a quarter of inflationary pressures we have not seen since the early 1980s.

Transportation Prices have always been bell-weather for economic activity. The exogenous shock of COVID-19 kicked off the runaway transportation markets of the last few years, and now it looks as though the exogenous shock of Russia’s invasion of Ukraine has ended it. Transportation Prices are more dynamic than any of our other metrics, and often lead to the other cost metrics. However, we should once again point out that Transportation Prices have not yet dipped into contraction as they did in 2019. Whether or not they eventually do enter a state of contraction, and whether the other costs will continue to slow their rates of expansion as well remains to be seen.

The index scores for each of the eight components of the Logistics Managers’ Index, as well as the overall index score, are presented in the table below. Seven of the eight metrics show signs of growth. Warehousing Capacity continues contracting for the 22nd consecutive month, slowing at a faster rate in June than in May. For the moment, supply chains are flush with inventory which is keeping inventory and warehousing metrics high, while transportation continues to rebalance.

| LOGISTICS AT A GLANCE | |||||

| Index | June 2022 Index | May 2022 Index | Month-Over-Month Change | Projected Direction | Rate of Change |

| LMI® | 65.0 | 67.1 | -2.1 | Growing | Slower |

| Inventory Levels | 71.8 | 69.3 | +2.5 | Growing | Faster |

| Inventory Costs | 83.8 | 88.1 | -4.3 | Growing | Slower |

| Warehousing Capacity | 41.0 | 45.9 | -4.9 | Contracting | Faster |

| Warehousing Utilization | 69.1 | 72.9 | -3.8 | Growing | Slower |

| Warehousing Prices | 78.4 | 87.5 | -9.1 | Growing | Slower |

| Transportation Capacity | 61.7 | 64.7 | -2.9 | Growing | Slower |

| Transportation Utilization | 58.4 | 64.3 | -5.9 | Growing | Slower |

| Transportation Prices | 61.3 | 65.3 | -3.9 | Growing | Slower |

This month, both upstream (blue bars) and downstream (orange bars) firms reported considerable rates of continued growth in the utilization of logistics services. In June we track significant differences in both Warehousing Utilization (+13.7 Downstream) and Warehousing Prices (+13.8 Upstream). It is interesting that we see differences in two warehousing metrics moving in different directions, but it does help inform the issues we’re seeing in different stages of the supply chain.

Warehousing Prices are growing everywhere, but are up more drastically in the Upstream supply chain as retailers cancel orders, forcing upstream firms to find extra space, likely on expensive short-term leases, to house inventory they never meant to hold on to. At the same time, Downstream firms are also slammed with inventory that is not moving nearly as fast as they had hoped. Additionally, many of these eCommerce retailers rely on a network of smaller urban facilities where space is constrained, leading them to move more quickly to utilize every inch of space available.

| Inv. Lev. | Inv. Costs | WH Cap. | WH Util. | WH Price | Trans Cap | Trans Util. | Trans Price | LMI | |

| Upstream | 75.0 | 85.6 | 37.7 | 64.0 | 83.6 | 60.6 | 60.0 | 63.4 | 65.8 |

| Downstream | 67.1 | 80.3 | 44.7 | 77.6 | 69.7 | 63.8 | 60.3 | 60.0 | 61.5 |

| Delta | 7.9 | 5.3 | 7.1 | 13.7 | 13.8 | 3.2 | 0.3 | 3.4 | 4.3 |

| Significant? | No | No | No | Yes | Yes | No | No | No | No |

Respondents were asked to predict movement in the overall LMI and individual metrics 12 months from now. Their predictions for future ratings are presented below. We see a marked shift in future predictions in June. The root of this shift is in inventories. Respondents predict that Inventory Levels will grow much more slowly over the next year (down 11.7 points) at a very moderate rate of 59.5. Future Inventory Costs are down as well to a still high, but 10.1 points slower, rate of 74.5. This may provide some insight into where supply chains are headed as firms are clearly hoping to wind down inventories in the face of slowing demand. The potential for lower orders is likely reflected in the drop in predictions for Warehousing Utilization (-10.5) and Price (-7.3) metrics as well. Finally, all three transportation metrics are down including Transportation Utilization (-5.1) and Price (-8.8). Interestingly, predictions for Transportation Capacity (-8.2) are down for the first time in a while. Over the past two years, this metric was held down mainly due to the combination of slow production and high demand, the dip we’re seeing now may be a recognition of slowing demand, causing firms to rethink their vehicle ordering strategies.

The exact nature of the future predictions varies by supply chain position. However, in June the only difference we observe is a marginal difference (9.6 points) in Inventory Costs, with Upstream firms anticipating a faster rate of growth. This difference may be reflective of the more limited expectation of upstream firms to sell down inventories quickly through aggressive pricing.

| Futures | Inv. Lev. | Inv. Costs | WH Cap. | WH Util. | WH Price | Trans Cap. | Trans Util. | Trans Price | LMI |

| Upstream | 60.3 | 78.0 | 57.2 | 69.1 | 77.2 | 58.5 | 61.3 | 59.2 | 61.6 |

| Downstream | 57.9 | 68.4 | 50.0 | 60.5 | 75.0 | 55.1 | 59.0 | 60.0 | 57.8 |

| Delta | 2.4 | 9.6 | 7.2 | 8.6 | 2.2 | 3.3 | 2.3 | 0.8 | 3.8 |

| Significant? | No | Marginal | No | No | No | No | No | No | No |

Historic Logistics Managers’ Index Scores

This period along with prior readings from the last two years of the LMI is presented table below. The values have been updated to reflect the method for calculating the overall LMI:

| Month | LMI | Average for last 3 readings – 67.3

All-time Average – 65.3 High – 76.5 Low – 51.3 Std. Dev – 7.11

|

| June ‘22 | 65.0 | |

| May ‘22 | 67.1 | |

| Apr ‘22 | 69.7 | |

| Mar ‘22 | 76.2 | |

| Feb ‘22 | 75.2 | |

| Jan ‘22 | 71.9 | |

| Dec ‘21 | 70.1 | |

| Nov ‘21 | 73.4 | |

| Oct ‘21 | 72.6 | |

| Sep ‘21 | 72.2 | |

| Aug ‘21 | 73.8 | |

| July ‘21 | 74.5 | |

| June ‘21 | 75.0 | |

| May ‘21 | 71.3 | |

| Apr ‘21 | 74.5 | |

| Mar ‘21 | 72.2 | |

| Feb ‘21 | 71.4 | |

| Jan ‘21 | 67.2 | |

| Dec ‘20 | 66.7 | |

| Nov ‘20 | 70.8 | |

| Oct ‘20 | 71.6 | |

| Sep ‘20 | 70.5 | |

| Aug ‘20 | 66.0 | |

| July ‘20 | 63.0 | |

| June ‘20 | 61.7 |

LMI®

The overall LMI reads in at 65.0 in June, down (-2.1) from May, and a full 10.0 points short of this same last year (although still up 3.3 points from the beginning of the initial recovery in June of 2020) down (-2.6). This marks the first time in 22 months that the overall index score has come in (barely) below the all-time average of 65.3. The slowing rate of growth can be contributed to a continued and the 9.1-point drop in Warehousing Prices. High Inventories continue to prop up the LMI, preventing the rate of expansion from dropping even further. It is worth remembering that while this is the slowest rate of expansion we have seen in nearly two years, it is still expanding.

Respondents expect a continued rate of moderate expansion through the next 12 months, predicting a growth rate of 60.4, down (-5.6) from May’s future prediction of 66.0. This slightly slower prediction is likely due to the softening in inventory expectations over the next year. It will be interesting to observe whether increasing interest rates and high fuel prices drive this down even further.

Inventory Levels

The Inventory Level value is 71.8, up 2.5 from last month, and down 8.4 from the index’s highest value four months ago. This month, upstream respondents reported greater inventory growth by 7.9 pts, (75.0 vs 67.1). Upstream inventories seem to be increasing faster than downstream. Last month, downstream respondents reported greater inventory growth by 3.1 pts, (71.4 vs 68.3). The average for the past five years has shown an uptick in June, and this year is no different. Inventories often begin to build in June in anticipation of back-to-school and holiday shopping, with reports of a large group of ships heading from Shanghai towards Southern California, we might expect continued growth throughout the next few months.

When asked to predict what conditions will be like 12 months from now, the average value is 59.5, down significantly from last month’s value (71.2). Upstream respondents are expecting slightly higher increases in inventory than downstream (60.3 vs 57.9). The average future value is well below the current index value of 71.8, meaning inventory growth over the next year is expected to be considerably lower than current values. While lightening the inventory load would certainly be helpful, firms should be careful not to overcorrect by canceling too many orders, as the bullwhip can swing towards both overstock and understock in fairly quick succession.

Inventory Costs

The current Inventory Costs index value is down slightly. The value of 83.8 is a decrease (-4.3) from last month. The last three months have been a downward trend from the record high value in March, although it is still high for the index, above the long-term average of 74.8. Given the high Inventory Levels index value, it is not surprising that Inventory Costs remain high. Over the last two years, the Inventory Costs index was stable in the mid-60s, until the fall of 2020, when the values began increasing steadily, until April of 2021, when the values reached the mid-80s, where they have remained, until breaking 90 in February. With some demand erosion and transportation and warehousing metrics slowing, it will be interesting to observe what happens with inventory metrics that remain strong or start to decline as well over the next few months.

Respondents seem to lean towards the latter option, predicting strong, but slightly slowed rates of growth over the next 12 months with a score of 74.5, down (-12.1) from May’s future prediction of 86.6. Similar to last month Upstream respondents were more bullish on cost growth, coming in 9.6 points higher than their downstream (78.0 vs 68.4) counterparts.

Warehousing Capacity

Breaking the trend from the previous three increased trends, the reading for Warehousing Capacity in June came in a 41.0, a 4.9-point decrease from the month prior. Additionally, this reading reflects a 0.3-point increase from the reading one year ago, and is also quite close to the reading from two years ago, only down by .7 points. This month’s LMI report also reveals that the growth rate for Inventory Levels is once again up. Taken together, the continued rise in inventory levels could be eating away at the minor increases in the capacity of warehousing. The causes of this decrease in Warehousing Capacity are likely manifold, however recent reports indicate that retailers have been inundated with back-ordered inventories. In addition, the COVID case levels and lockdowns in China easing over the past month allowing trade to open up, as well as the continued pressure that the war in Ukraine is having on global supply chains remains a concern.

Looking forward to the next 12 months, respondents have shifted towards expecting some (albeit moderate) level of growth in Warehousing Capacity. The predicted Warehousing Capacity index is 55.4, very similar (-0.4) to May’s future prediction of 55.9 and up (+6.2) from April’s future prediction of 49.3. Respondents have become cautiously optimistic that the additional space needed to meet demand will begin to come online.

Warehousing Utilization

The Warehousing Utilization reading came in at 69.1 for June 2022, which reflects a 3.8-point decrease from the month prior, a 6.4-point decrease from the reading one year ago, though is up 3.6 points from the reading two years ago. The slowing rate of utilization expansion is rather interesting, given the dip in capacity. There are several possible reasons for this, but the most likely cause is that over the span of the LMI, there is an approximate 1-3 month lag (generally speaking) between the effect of capacity shifts on utilization and pricing of warehousing. That is, if we look at the reading from May 2022 for capacity it is increased, whereas the reading for utilization this month is decreased. Also of note in this reading is that there is a statistically significant difference between the upstream and downstream average ratings, where downstream respondents are indicating that their utilization levels are over 13 points higher than upstream. As noted above, this is very likely due to the glut in recent inventory from backlogged orders. This reading also should be viewed in light of recent reports of inventory levels increasing, in addition to previous increases to capacity levels.

Looking forward to the next 12 months, the predicted Warehousing Utilization index is 65.0, down (-10.5) from May’s future prediction of 75.5. As inventory levels recede, respondents are becoming hopeful that warehousing space will become less precious, easing the ongoing struggle to keep up with demand.

Warehousing Prices

Warehousing Prices registered at 78.4 for June 2022’s reading, reflecting a 9.1-point decrease from the month prior, and a 7-point decrease from one year ago, marking the first time this metric has dipped below 80.0 since February 2021. Despite the 9-point dip in growth rates, this is still a strong rate of expansion (it’s a 17.8-point Increase from the reading two years ago) and it will be interesting to observe whether this metric will continue to dip or reach some plateau in the coming months. Much like the relationship between utilization and capacity, pricing also experiences a 1-3 month lag, generally speaking. Also of note in this month’s reading is that there is a statistically significant difference between the upstream and downstream pricing levels, showing a higher level upstream than downstream. The decrease in the rate at which the pricing of warehousing is increasing has been on a slight downward trend, yet decreased capacity coupled with increased demand and a dynamic geopolitical landscape may alter the trajectory of this reading.

Future predictions suggest that respondents are expecting prices to continue to grow at a rate of 76.6, down (-7.3) from May’s future prediction of 83.9, and 10.1-points down from April. (-2.8) from April’s future prediction of 86.7. Respondents are still anticipating growth, although clearly there is some optimism that it will be slower growth, leading to more affordable storage options.

Transportation Capacity

The Transportation Capacity Index registered 61.7 percent in June 2022. This constitutes a jump of 3 percentage points from the May reading of 64.7. Despite this drop, the transportation capacity index remains above 50, indicating expansion. The Transportation Capacity expansion can be observed across the supply chain, with the upstream index indicating 60.6 and the downstream index indicating 63.8.

The future Transportation Capacity Index also indicates slight expansion, registering 56.6. Upstream firms have a future transportation capacity index of 58.5 while downstream firms indicate a future expectation of 55.1. Overall, it can be said that the slight capacity increase expectations are widespread across the supply chain and are expected to continue over the next 12 months.

Transportation Utilization

The Transportation Utilization Index registered 58.4 percent in June 2022. This denotes a drop of 5.9 percent decrease from the 64.3 level registered in May 2022. This brings the Transportation Utilization index to the lowest level observed in the last two years. As such, the Transportation Utilization index is now approaching the critical 50 level which separates expansion and contraction.

The future Transportation Utilization Index indicates continuing expectations of slight expansion, at a 60.1 level for the next 12 months. The slight expansion expectations are distributed relatively uniformly across the supply chain, with the downstream future index indicating 59.0 and upstream indicating 61.3. Hence, the days of expansionary transportation utilization are still here for now, but the rate of expansion is decreasing.

Transportation Prices

The Transportation Prices Index registered 61.3 percent in June 2022. This corresponds to a drop of 4 percent from the May Transportation Prices reading of 65.3. While the index remains above 50, indicating that prices are still increasing, this is the third consecutive drop in the Transportation Prices index, pushing it lower than at any point in the past two years. Further, the downward trend in price pressure continues to be observed across the supply chains, with the upstream price index at 63.4 and the downstream price index at 60.0.

The future index for Transportation Prices indicates a value of 59.6, indicating expectations of slight price increases for the next year. The price increase expectations are slightly higher for downstream firms (index is at 60.0) than for upstream firms (index is at 59.2) but both readings are lower than previous expectations.

About This Report

The data presented herein are obtained from a survey of logistics supply executives based on information they have collected within their respective organizations. LMI® makes no representation, other than that stated within this release, regarding the individual company data collection procedures. The data should be compared to all other economic data sources when used in decision-making.

Data and Method of Presentation

Data for the Logistics Manager’s Index is collected in a monthly survey of leading logistics professionals. The respondents are CSCMP members working at the director level or above. Upper-level managers are preferable as they are more likely to have macro-level information on trends in Inventory, Warehousing, and Transportation trends within their firm. Data is also collected from subscribers to both DC Velocity and Supply Chain Quarterly as well. Respondents hail from firms working on all six continents, with the majority of them working at firms with annual revenues over a billion dollars. The industries represented in this respondent pool include, but are not limited to Apparel, Automotive, Consumer Goods, Electronics, Food & Drug, Home Furnishings, Logistics, Shipping & Transportation, and Warehousing.

Respondents are asked to identify the monthly change across each of the eight metrics collected in this survey (Inventory Levels, Inventory Costs, Warehousing Capacity, Warehousing Utilization, Warehousing Prices, Transportation Capacity, Transportation Utilization, and Transportation Prices). In addition, they also forecast future trends for each metric ranging over the next 12 months. The raw data is then analyzed using a diffusion index. Diffusion Indexes measure how widely something is diffused, or spread across a group. The Bureau of Labor Statistics has been using a diffusion index for the Current Employment Statics program since 1974, and the Institute for Supply Management (ISM) has been using a diffusion index to compute the Purchasing Managers Index since 1948. The ISM Index of New Orders is considered a Leading Economic Indicator.

We compute the Diffusion Index as follows:

PD = Percentage of respondents saying the category is Declining,

PU = Percentage of respondents saying the category is Unchanged,

PI = Percentage of respondents saying the category is Increasing,

Diffusion Index = 0.0 * PD + 0.5 * PU + 1.0 * PI

For example, if 25 say the category is declining, 38 say it is unchanged, and 37 say it is increasing, we would calculate an index value of 0*0.25 + 0.5*0.38 + 1.0*0.37 = 0 + 0.19 + 0.37 = 0.56, and the index is increasing overall. An index value above 0.5 indicates the category is increasing, a value below 0.5 indicates it is decreasing, and a value of 0.5 means the category is unchanged. When a full year’s worth of data has been collected, adjustments will be made for seasonal factors as well.