Dave Baiocchi

Dave Baiocchi MHEDA Rental Strategies II

Last month, I started a series based on the information and ideas presented at the 2019 MHEDA Rental and Used Equipment Conference. This conference was held in October of 2019, and during the conference, I shared ideas and strategies with the attendees regarding best rental practices, and strategies.

Although the information provided by the speakers was relevant and useful, some of the most exciting ideas were shared across the table at the breakout sessions. The idea that makes a difference for the dealership isn’t always part of the featured presentation. Last month, I shared ideas on the following rental topics:

- Rate setting

- Creating consistent revenue – Multi Season Rental

- Rental Purchase Options – Using sliding scales

- Leveraging telematics – Service scheduling

- Leveraging telematics – Billing

This month I want to focus on more operational and strategic rental practices including:

Depreciation allowances and capitalizing expenses

When we sell equipment, calculating profitability is an easy task. The sales price minus our related expenses equals our gross profit. Rental profitability however is more of a moving target. As a dealer we get to decide how much of our rental billing will be applied to depreciation of the asset, as well as how much to preserve for maintenance and repair. What remains should be enjoyed as profit.

In recent years, the government has incentivized the purchase of capital equipment by providing tax incentives in the form of accelerated depreciation. This does NOT however need to affect our book values on equipment. Tax allowances are one thing. Applying actual rental income to book values is a different thing altogether.

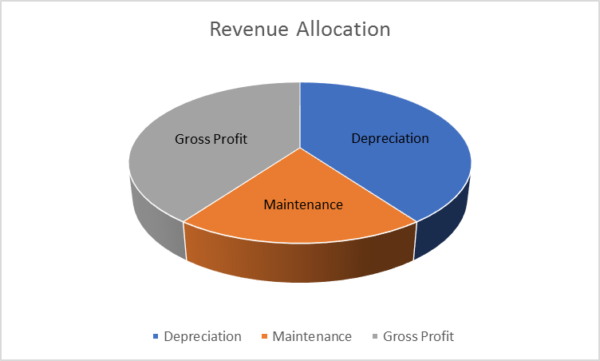

High profit short term “rent to rent” dealer operations normally yield a net profit of about 40% from their retail monthly rental rates. This assumes that 20% of your rate will be allocated for maintenance and repair, while 40% will be posted against unit depreciation and interest.

This allocation is predicated on starting with NEW units. If you introduce used units into the fleet (depending on the age and condition of the units), the life cycle, maintenance budget and depreciation schedule may be much different.

There are those occasions where a repair made to a rental unit actually improves the value of the unit to the point where the cost of the repair can be added to the book value of the unit, instead of being recognized as an expense against your rental income. This is dangerous territory. Many a rental manager has found himself awash in overvalued inventory because he talked himself into capitalizing expenses that really did not improve the units market value. Capitalized repairs should be limited to large components like engines, transmissions, motive power batteries, or mast assemblies. Even then, only capitalizing a “portion” of these repairs may be a prudent idea. The fact is, most of these components just don’t regularly fail in the course of a unit’s rental life. Be careful…it’s a slippery slope.

Billing OT and Damage

A common error in many rental departments is quoting rates without tying them to a specified duty cycle. Unlike the auto rental business, equipment rentals are not designed to allow for “unlimited” usage. Standard quoted rental rates should be limited to no more than 160 hours per month. This represents a single shift (normal and clean) rental environment. If we are already aware that the rental application will be multiple shift, and/or a severe application we can either specify an overtime charge (per hour for every hour over $160/mo.), or simply raise the rate with a high allowance.

Either way…there’s no free lunch. Your fleet shows its age in hours and application severity. If you want a profitable rental fleet, you have to charge the customer for using the equipment above and beyond the norm.

Inspecting rental units after they arrive and IMMEDIATELY billing damage to the customer is another area where a lot of dealers can be more diligent. Provide incentives to yard workers to FIND damage, and they may actually look for it. The final assessment on what is billable is up to you, but let’s at least look for the signs of abuse with some intent and forethought.

The key to recovering abuse repairs is QUICK ACTION. You MUST report back damages complete with digital photos to the customer the day the unit is returned. Wait longer than 24 hours and you invite an argument over who actually damaged the lift.

COI and LDW

Every time a rental leaves your yard, you should have a certificate of insurance on file for the customer. Yes, every unit you own is probably already covered by your own liability policy, but why should you risk an insurance rate increase, when the fault for damages lies squarely on the customer. Simply ask the customer for a certificate of insurance naming your dealership as “additionally insured”.

Customers that do not provide a certificate should be charged a fee (normally 12% to 20%) of the rental amount to cover the cost of a loss damage waiver (LDW). This is normally enough to purchase LDW coverage from an insurance supplier, but in most cases, dealers route this income to a stand-alone GL that is used as a fund to cover the cost of damage should it occur.

This should be a “deal breaker” and a standard “no exceptions” policy for all rental operations within the dealership.

Maximizing parts warranty recovery

In the heat of the rental season, when the phones are ringing and equipment is moving, it’s easy to forget that DETAILS MATTER. I have seen a lot of money get wasted when dealers do not have hard and fast rules governing the warranty recovery.

Tracking OEM Equipment warranty is not difficult and most dealers have measurements to ensure that they are obtaining maximum recovery on both BASIC and EXTENDED coverages for all of the OEM’s. But what about PARTS warranty? Most OEM’s also provide a warranty on genuine replacement parts for at least six months. If a dealer technician installed the parts, the OEM in many cases reimburses the labor as well.

This is not as easy to track as regular warranty claims, and will require dispatchers and service administrators to have visibility and easy access to service history work orders in your operating system. If you have the proper SOP in place to govern the work order process, technicians and warranty administrators can be advised in advance of the component parts that have been replaced on a rental unit in the prior 6 months. The list of candidates for parts warranty is well known, and almost always includes starters, alternators, and batteries. With all of the advanced technology and emissions controls on the equipment today, a deeper dive may pay dividends. ECM, VCM, EGR systems, and electronic controllers should be included on the watch list of warranty possibilities. Emissions parts are mandated by law to have warranty periods of 36 to 60 months, so replacement of any exhaust component should trigger additional scrutiny.

The rental platform in a dealership provides multiple opportunities to make money, save money, and avoid the tax man. Rental department goals should be the product of a well-constructed strategy that includes target marketing, expense control, warranty maximization, and insurance compliance. All the while you need to manage a book value depreciation schedule that ensures both rental, and used equipment profitability.

About the Author:

Dave Baiocchi is the president of Resonant Dealer Services LLC. He has spent 37 years in the equipment business as a sales manager, aftermarket director and dealer principal. Dave now consults with dealerships nationwide to establish and enhance best practices, especially in the area of aftermarket development and performance. E-mail [email protected] to contact Dave.