Garry Bartecki

Garry Bartecki Getting closer

I am sitting at my computer on May 14 wondering if my T Bills will be worth anything two weeks from now. I must tell you, on a financial front, we are in deep Dudu if we default on our debts. WHAT A MESS.

And if I get bored, I run to YouTube to see what I can find out about where the EV (Electric Vehicle) vs ICE (Internal Combustible Engine) debate stands. Came across one program that was pretty good where they compared EV total cost against an ICE total cost over 125,000 miles.

As it turns out the EV purchase cost is well in excess of a similar ICE model, but not as much if you take into account the $7,500 credit available on new EV’s. But let’s remember you must be able to “pay” for the EV and will not get the benefit of the if you don’t have at least $7,500 tax to pay. And it is probably safe to say that you need at least a $100,000 annual income to wind up with that type of tax.

The bottom line is that the total cost (cost to purchase plus operating costs) over $125,000 was about the same at $65,000. The higher purchase price of the EV plus fueling was the same as the lower-priced ICE unit with the cost of gasoline and repairs. Thinking further ahead you would expect the EV cost to decrease as demand climbs, which could reduce total cost to the point where EV wins the cost game (if the demand for electricity does not get so high that cost increases get to the point where we once again wind up with a tie). Could happen.

For me, I am thinking there are other alternatives that could provide similar climate benefits for less cost. Hydrogen in some form is that option. During my visit to ProMat I had a chance to spend some time with Plug Power while they were showing off how one of their units could be used with lift trucks. Less operating hassle compared to both acid and lithium batteries but similar overall run times per charge. And having H20 as the exhaust is not bad either. Toyota has developed an engine that operates along this line and concludes that EV is not necessary if buyers use the Toyota as an alternative to EV. Dealers, as far as lift trucks go, this is an option you have to keep in mind because customers are going to ask about it.

As far as our financial picture is concerned, I believe it will be tougher than expected, mainly because of the banking crunch taking place. With BK’s increasing banks take steps to review their outstanding loan portfolio to see if they have any substantial risk to consider. Being in this frame of mind banks are cutting back on new financing requests or asking for tighter coverage on existing bank loans. We discussed this topic and reaction before, and I really cannot blame the banks if they decide they must cover their butts to stay solvent. But let’s not forget that these issues also concern your customers, especially those who constantly pay late or have known cash flow problems. In the end, the banking situation will slow the economy down to where we can prepare for a hard landing.

To assist with your planning for any type of downfall that may appear, last month we went through a Balance Sheet (BS) exercise where I suggested you investigate cleaning up the BS with a goal to convert as many assets as possible into CASH because you are going to need it. The alternative is a balance sheet with assets decreasing in value once the recession goes into full swing, which, of course, are part of your bank collateral which the bank will be reviewing on an annual basis.

Now, let’s discuss the Income Statement (IS) which, of course, represents how we did profit-wise over a segment of time.

You all have an idea of how the IS works and understand that it is entirely possible, with all the changes taking place in BUSINESS these days, that Income Statement results could put a strain on the BS, your cash position, and the overall value of the company. Consequently, knowing what is likely around the bend I do not believe you can sit back and say there are no changes required in your business. You can, of course, come to that conclusion, but please do so after you have examined all your risk factors and find nothing out of order. And heck, I haven’t even mentioned AI yet!

I expect a reduction in overall revenues (net of inflation) to soften up to the point where you will be glad that you have that extra cash available because of converting assets into cash. In other words, covering your fixed and variable costs will require both a more profitable business as well as cost reduction. I also do not see the negative impacts on your business reversing itself post-recession. Some items are just too sticky to do that.

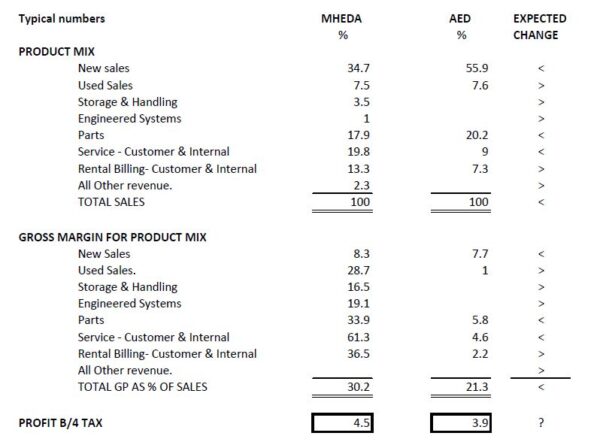

So, let’s go through an IS statement review this month using typical MHEDA numbers, and see what potential changes to anticipate and plan for. To help us focus I put together a brief review of a dealer’s potential sales mix and gross profit percentages and provide my thoughts on what to expect going forward.

For comparison purposes, I also added similar data from the construction dealer side. My overall comments will be addressed to lift truck dealers and not so much to the construction side.

I listed the dealer’s revenue and gross profit line items and then in the far-right column indicate what I expect each line item to do (net of inflation) based on my crystal ball to date. > representing an increase in the line item. < a decrease.

New Sales

I expect sales levels to fall as a result of both less demand and lower price points now that supply change issues are correcting themselves. Also expect new units to last longer, thus negating purchase patterns of the past. And, as far as I know, the new sale line could be zero at some point if OEMs decide to sell direct.

Used sales

Can see Used Sales increasing if potential customers prefer to keep historical products because they are used to them and can purchase them at a price point, they can afford and finance. Can also see a need for dealers to “clean house” to generate cash, thus making used sales more attractive to customers. Right now, used sales can produce attractive pricing for dealers if they take advantage of market value considerations. On the other hand, this pricing advantage will reverse itself once newer units become available where the utility value of a used unit cannot stand up to what newer units offer. Let’s get those used units ready to sell.

And let’s not forget that used sales should include all expendable used rental units.

Storage handling and engineered systems

This category is where the money is going to be made and how you are going to win larger more sophisticated technology-oriented customers. Dealers will need to understand how the warehouse and manufacturing floors are going to operate in this digital adventure over the next five years, if not sooner. Dealers need to educate themselves and partner up with technology organizations ready to attack these new methods including AI. There is little doubt that products and services, along with a deep understanding of how to maximize the use of such services are what your customer needs and expects from you. If dealers are not prepared to work in these areas, they should ask for assistance from OEMs to find partners to work with and learn from. You may not know it yet, but you are going into a new business in the very near future.

Parts and service

I believe that customers will rent more until they figure out what equipment they need to make them more profitable and as a result buy less equipment as well as require less parts and service work. The reduction of both PS also results from new better-engineered equipment that lasts longer with overall fewer maintenance requirements. And if there are major changes if the type of equipment in use, those old parts you have on the BS will become more and less valuable as time goes on.

Rental

Expect more rentals because of customer financing needs and a need to “try” new stuff as it hits the market. Hey, here is where you can get into climate change by converting your service units into EV units (if it makes sense). On the other hand, customers with new technology being implemented (hopefully by you) may not require the number of lift trucks they used previously. More rent-to-sell should be considered. And let’s consider that customers may require more efficient types of equipment using Lithium or Hydrogen to cut operating costs.

Total Sales

Expect lower Total Sales. New sales, parts, and service, three of your biggest revenue producers, I expect to decrease net of inflation.

Gross margins

My indicators for GM are used to indicate if I see you have more absolute $ from these line items or not. If Sales decrease in the three major categories I doubt if GM in absolute $ will be more in the next 12 months compared to the prior year for the same period. Dollars required for absorption will be lacking, thus making it necessary to reduce both manpower and other business expenses, especially fixed expenses.

Profit before tax

I give up and leave this line with a “?”. If you do your homework and devise a transition plan that will increase your cash flow as well as your Profit Before Tax, then> you will get.

Thought for the day

I HOPE EVERY SALES LINE-ITEM INCREASES ALONG WITH MARGINS TO PRODUCE MORE THAN ENOUGH CASH FLOW THAT MAKES ALL YOUR BANK REPORTS A PLEASURE FOR YOUR BANKER TO READ.

But what if the recession is more painful than expected and the bankers cut off capital to the point where every business must reduce their operations to match current conditions? If that scenario goes “green”, hopefully, your plans prepared to deal with these various scenarios offset any material negative result.

About the Columnist:

Garry Bartecki is a CPA MBA with GB Financial Services LLC and a Wholesaler columnist since August 1993. E-mail [email protected] to contact Garry.