YRC Worldwide reports First Quarter 2019 results

YRC Worldwide Inc. has reported their consolidated operating revenue for first quarter 2019 of $1.182 billion and consolidated operating loss of $31.7 million, which included a $1.6 million net loss on property disposals. As a comparison, for the first quarter 2018, the Company’s results included operating revenue of $1.215 billion and consolidated operating loss of $4.3 million, which included a $3.2 million net loss on property disposals.

“Our primary focus during first quarter was securing a new labor agreement that was scheduled to expire on March 31, 2019. I am pleased to announce that on May 3, 2019, our employees approved the national agreement and 26 of the 27 applicable supplemental agreements,” said Darren Hawkins, Chief Executive Officer of YRC Worldwide. “Leading up to the approval of the five-year agreement, we experienced the effects of some customer concerns around the uncertainty of the negotiations process. While we cannot precisely quantify the revenue loss related to the labor agreement, our first quarter results were adversely impacted.”

Hawkins added, “During the first quarter, our freight operations were negatively impacted by severe winter weather events. Approximately half of the 63-day quarter was impacted by weather events for both YRC Freight and our largest Regional carrier, Holland, resulting in limited or closed operations across our 384-facility network. Holland was significantly impacted during a two-week period in late January, in which more than 25% of its’ network was down or severely limited.

“As we move through 2019, we will continue to prioritize yield over tonnage. We believe the new labor agreement provides both long-term value and opportunity for our employees, our customers, and our shareholders and it will be our number one priority to execute on the new contractual operational capabilities.

“At the very core of our 2019 strategy is network optimization. The initiative has multiple layers – with the primary objectives of enhancing service, creating opportunities for productivity improvements, and streamlining our cost structure as we seek to eliminate inefficiencies across the network, providing the potential for revenue growth and margin expansion,” said Hawkins.

Financial Highlights

- In first quarter 2019, net loss was $49.1 million compared to net loss of $14.6 million in first quarter 2018.

- On a non-GAAP basis, the Company generated consolidated Adjusted EBITDA of $30.1 million in first quarter 2019, a decrease of $15.6 million compared to $45.7 million for the same period in 2018 (as detailed in the reconciliation below). Last twelve month (LTM) consolidated Adjusted EBITDA was $321.9 million compared to $276.7 million a year ago.

- The total debt-to-Adjusted EBITDA ratio for first quarter 2019 improved to 2.76 times compared to 3.32 times for first quarter 2018.

- First quarter 2019 results included a non-cash impairment charge at YRC Freight of $8.2 million. The non-cash impairment charge reflects the write-down of an intangible asset as a result of rebranding strategies, leading to discontinued use of a tradename. The non-cash expense is included in operating loss and excluded from Adjusted EBITDA.

- Investment in the business continued with $32.6 million in capital expenditures and new operating leases for revenue equipment with a capital value equivalent of $25.3 million, for a total of $57.9 million, which is equal to 4.9% of operating revenue for first quarter 2019. The majority of the investment was tractors, trailers and technology.

Operational Highlights

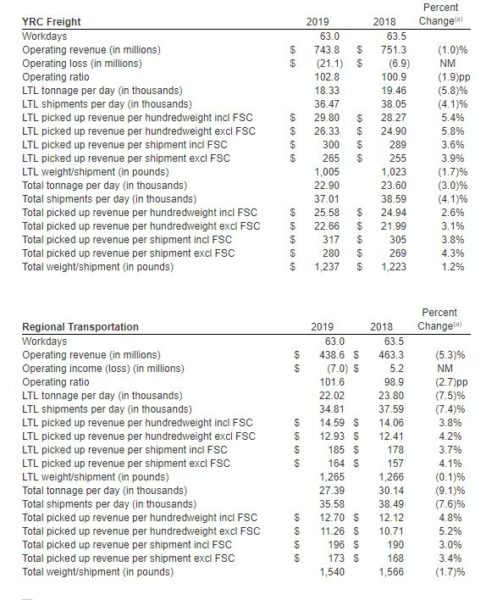

- The consolidated operating ratio for first quarter 2019 was 102.7 compared to 100.4 in first quarter 2018. The operating ratio at YRC Freight was 102.8 compared to 100.9 for the same period in 2018. The Regional segment’s first quarter 2019 operating ratio was 101.6 compared to 98.9 a year ago.

- At YRC Freight, first quarter 2019 less-than-truckload (LTL) revenue per hundredweight, including fuel surcharge, increased 5.4% and LTL revenue per shipment increased 3.6% when compared to the same period in 2018. Excluding fuel surcharge, LTL revenue per hundredweight increased 5.8% and LTL revenue per shipment increased 3.9%.

- At the Regional segment, first quarter 2019 LTL revenue per hundredweight, including fuel surcharge, increased 3.8% and LTL revenue per shipment increased 3.7% when compared to the same period in 2018. Excluding fuel surcharge, LTL revenue per hundredweight increased 4.2% and LTL revenue per shipment increased 4.1%.

- First quarter 2019 LTL tonnage per day decreased 5.8% at YRC Freight and decreased 7.5% at the Regional segment compared to first quarter 2018.

- Total shipments per day for the first quarter 2019 declined 4.1% at YRC Freight and 7.6% at the Regional segment.

Liquidity Update

- At March 31, 2019, the Company’s outstanding debt was $884.5 million, a decrease of $34.2 million compared to $918.7 million as of March 31, 2018.

- The Company’s available liquidity, which is comprised of cash and cash equivalents and Managed Accessibility (as detailed in the supplemental information provided below) under its ABL facility totaled $155.7 million compared to $117.2 million as of March 31, 2018, an increase of $38.5 million.

- For the three months ended March 31, 2019, cash used in operating activities was $41.7 million compared to cash used in operating activities of $3.7 million for the three months ended March 31, 2018.

Key Segment Information – first quarter 2019 compared to first quarter 2018

(a) Percent change based on unrounded figures and not the rounded figures presented

The Company uses key operating metrics to provide a comparison with industry peers. Two primary components include volume (commonly evaluated using tonnage, tonnage per day, total shipments, shipments per day or weight per shipment) and yield or price (commonly evaluated as picked up revenue, revenue per hundredweight, or revenue per shipment). With the enhanced focus of service and product expansion and the launch of HNRY Logistics in late 2018, our increase in shipments over 10,000 pounds is growing, impacting the year-over-year revenue per hundredweight metrics that we have historically presented for YRC Freight, which includes the results of operations for HNRY Logistics. Therefore, the Company has updated its presentation of operating metrics to separately present less-than-truckload (LTL) operating statistics, which represents shipments less than 10,000 pounds. Shipments greater than 10,000 pounds are primarily transported using third-party purchased transportation.

To view full release, click here.