Warehouse construction declines by 25% in 2023

-

Demand for mobile robots has increased, while demand for end-to-end fixed automation slowed in 2022.

-

The COVID-19 pandemic had a significant impact on e-commerce, fueling demand for warehouse automation.

-

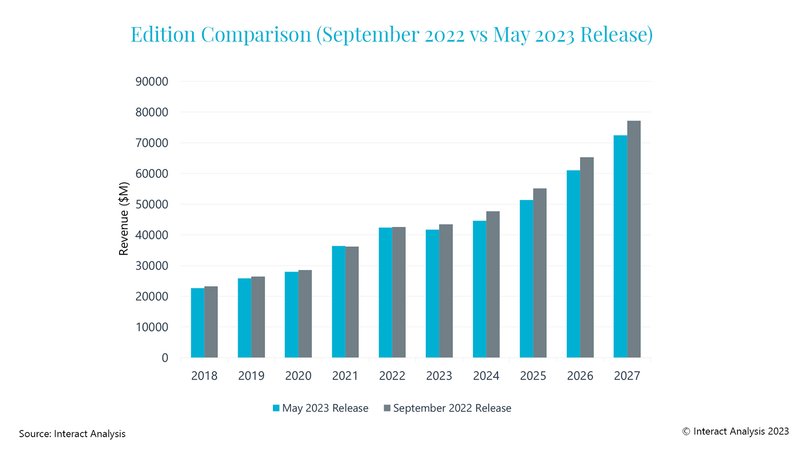

Total market size for warehouse automation will be 6% lower in 2027 than initially forecast, owing to a negative adjustment to our fixed automation forecast.

While demand for mobile robots has increased this year, the number of new warehouses being built in North America and Europe has declined during 2023, according to new research from Interact Analysis. The market intelligence specialist reveals in the latest update to its warehouse automation premium market research report that the fall in warehouse building is having a knock-on effect on demand for end-to-end automation projects.

Compared with 2022, there has been a 25% slowdown in the number of new warehouses being built in the US and Europe in 2023, and, as a result of this, demand for end-to-end automation decreased. However, the slowdown is expected to be short lived and warehouse construction is predicted to pick up again by 2025. The APAC region has been less affected by the current macroeconomic volatility; however, Interact Analysis does expects a slight slowdown in growth for this region in 2023.

The mobile robot market has enjoyed exponential growth in recent years and will continue to do so over the next 5 years. Interact Analysis has increased its forecast projection for this segment of the market despite forecasting a slight downward trend for fixed automation demand. The reason for the adjustment to our forecast is mainly driven by the automated forklift segment and slower price erosions.

The slowdown in e-commerce growth has had a direct impact on the demand for automation from the grocery, apparel and general merchandise segments. Traditionally, these have been the fastest growing segments, while vertical markets upstream in the supply chain, such as manufacturing, have experienced slightly slower growth. However, in 2022 demand for automation from grocery, apparel, and general merchandise slowed down as a result of the decline in e-commerce, while upstream vertical markets like durable manufacturing and food & beverage have experienced strong growth, driven by near-shoring.