The U.S. Plastics Industry in 2023 in seven charts

Assessing the plastics industry landscape in 2023 reveals a year marked with nuanced shifts across various sectors. From the fluctuations in production levels and shipments to the intricate interplay between labor constraints and export dynamics, the plastics industry encountered challenges and opportunities. Notably, the year witnessed divergent trajectories: while certain segments, such as plastics material pricing and resin manufacturing, grappled with equilibrium adjustments, others, like the mold for plastics trade, mirrored global economic oscillations. Unpacking these trends and projections explains a complex narrative of the industry’s path ahead into 2024.

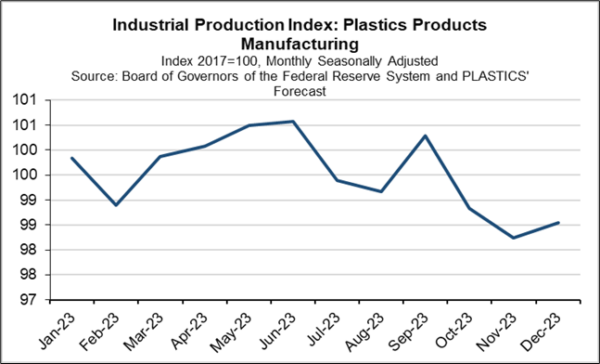

1. Plastic Products Manufacturing

2023 saw a notable pullback from the production levels of 2022. The initial increase starting in March did not maintain momentum for the rest of the year. A significant decline occurred in July, followed by another downturn in August. While September witnessed a slight increase, it was followed by successive declines through November. There is a likelihood that production increased marginally in December. It is anticipated that the rate of decline in plastics production in 2024 will be lower than that observed in 2023.

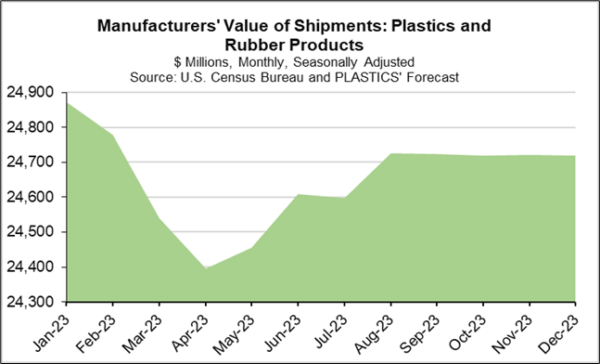

2. Plastics and Rubber Shipments

In 2023, the shipments of plastics and rubber remained relatively stable, hovering between $24.4 billion and $24.9 billion. Although there was an initial decline in the first four months, they rebounded until August before stabilizing, with minimal fluctuations projected for November and December. Despite robust economic growth, primarily fueled by personal consumption accounting for 87% of plastics production, inventories remained elevated, prompting a decrease in plastic shipments. Initial projections for 2024 indicate a tepid rise in shipments of plastics and rubber, signaling a modest increase.

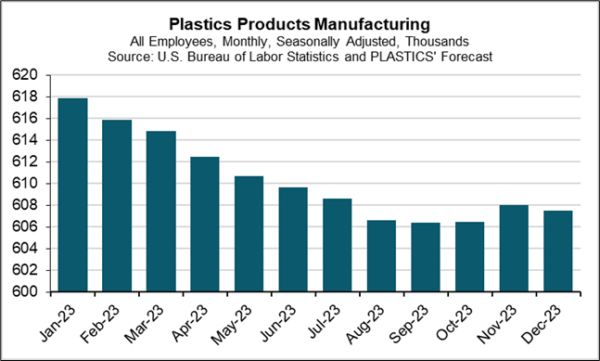

3. Plastics Manufacturing Employment

The U.S. plastics industry grappled with persistent labor supply constraints throughout 2023, echoing the challenges experienced across the broader manufacturing sector. From January to December, there was a probable 1.7% decrease in the workforce engaged in plastics product manufacturing. According to the U.S. Bureau of Labor Statistics, an estimated 608,000 employees were working in plastics products manufacturing in November, likely declining to 607,500 by December. The ongoing disparity between job openings and actual hires in manufacturing is anticipated to have persisted throughout November and December. These persistent imbalances in labor demand and supply, including within the plastics industry, are forecasted to extend into 2024.

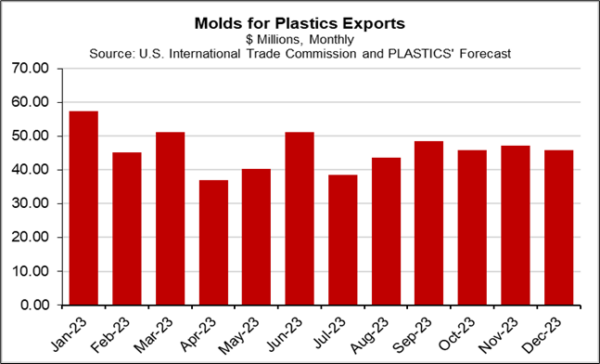

4. Molds for Plastics Trades

The slowdown in U.S. manufacturing and weakened economic conditions in export markets became evident in the molds for plastics trade. Projections suggest a notable 8.8% decrease in exports based on dollar value for 2023. Although the decline in inflation might indicate a lower dollar value of exports, year-to-date exports until October dwindled by 13.2% compared to the same period in 2022. Exports of molds for plastics fluctuated monthly, ranging between $37.0 million and $57.3 million. October indicated a potential 2.9% rise in export value, but these gains might have been tempered in December, historically a weaker month for exports compared to other months. Anticipating a global output slowdown in 2024, particularly in advanced economies, while stabilizing in emerging and developing economies, it’s likely that any improvements in molds exports will be weaker compared to the preceding two years.

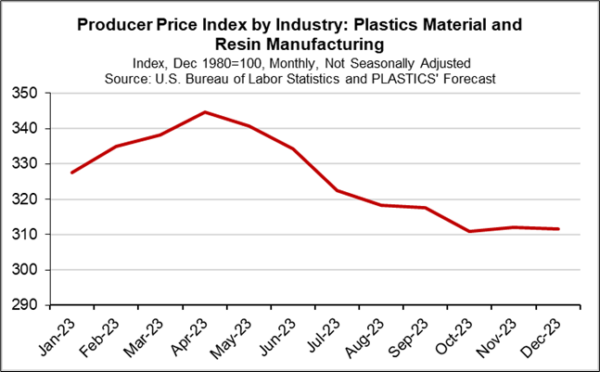

5. Producers Prices in Plastics Material and Resin Manufacturing

Plastics material and resin prices hit their peak in April this year, then gradually fell as demand and supply rebalanced. Reduced U.S. plastics production tempered resin demand, while supply increased from July to October compared to the previous year. November saw a 0.4% price hike, but December may mark a 0.2% decrease. Barring unexpected disruptions like adverse weather affecting resin production, it is unlikely we will see a reversal in the recent path of resin prices in 2024.

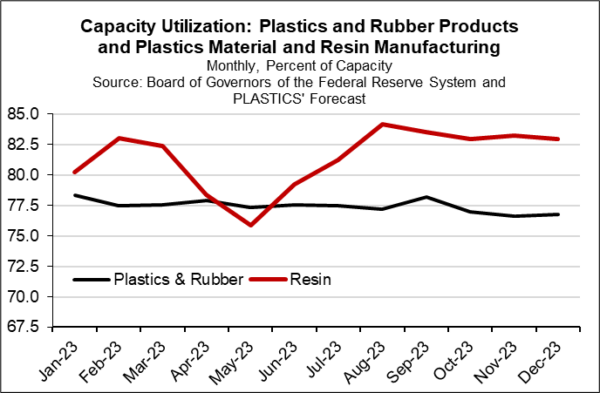

6. Capacity Utilization Rates in Plastics and Resin Manufacturing

The capacity utilization rate in plastics product manufacturing declined throughout 2023, averaging 83.1% monthly in the preceding year and dropping to an average of 77.4% for the year, with an anticipated rate of 76.6% for December. This decline aligns with the observed decrease in plastics conversion activity during the year. Conversely, capacity utilization in plastics material and resin manufacturing experienced an uptick, notably increasing in the latter half of the year. December might have seen a slight decrease in both capacity (0.1%) and utilization rate (0.4%). The imbalance between resin supply and demand contributed to the decrease in the Producer Price Index for plastics material and resin manufacturing in 2023. Projections for 2024 suggest an anticipated increase in capacity utilization for resin manufacturing, albeit possibly at a slower pace compared to 2023.

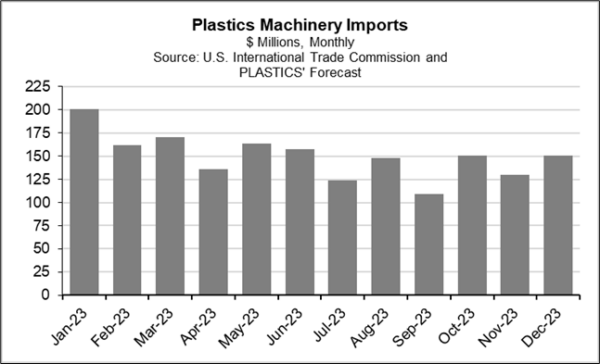

7. Plastics Machinery Imports

The U.S. imported plastics machinery amounting to $1.8 billion, with projected import values of $129.4 million in October and $150.1 million in November. This year’s total imports have decreased by 4.4% compared to the previous year. As a primary importer of plastics equipment, this data serves as a key indicator for understanding plastics manufacturing. Typically, an upsurge in plastics machinery imports signifies robust plastic conversion. The reduced imports of plastics equipment this year correlate with the decline in plastics product manufacturing. The possibility of an uptick in plastics equipment imports in 2024 relies on increased plastics production, provided there is a limited inventory of plastics equipment available.

About the Author:

The Plastics Industry Association (PLASTICS) is the only organization that supports the entire plastics supply chain, including Equipment Suppliers, Material Suppliers, Processors, and Recyclers, representing over one million workers in our $548 billion U.S. industry. PLASTICS advances the priorities of our members who are dedicated to investing in technologies that improve capabilities and advances in recycling and sustainability and providing essential products that allow for the protection and safety of our lives. Since 1937, PLASTICS has been working to make its members, and the seventh largest U.S. manufacturing industry, more globally competitive while supporting circularity through educational initiatives, industry-leading insights and events, convening opportunities and policy advocacy, including the largest plastics trade show in the Americas, NPE2024: The Plastics Show.