October 2023 Manufacturing Technology orders up over September but down from 2022

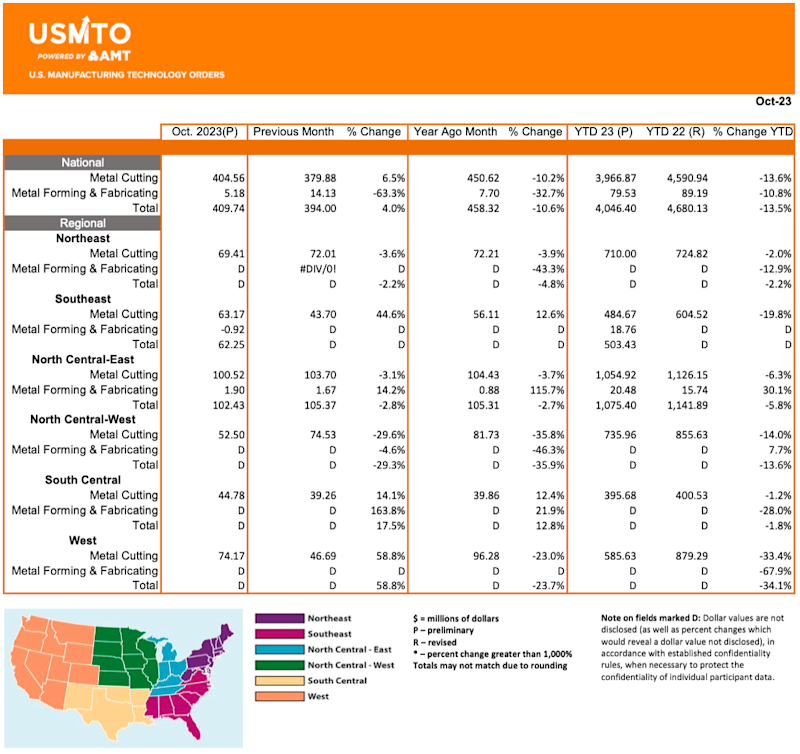

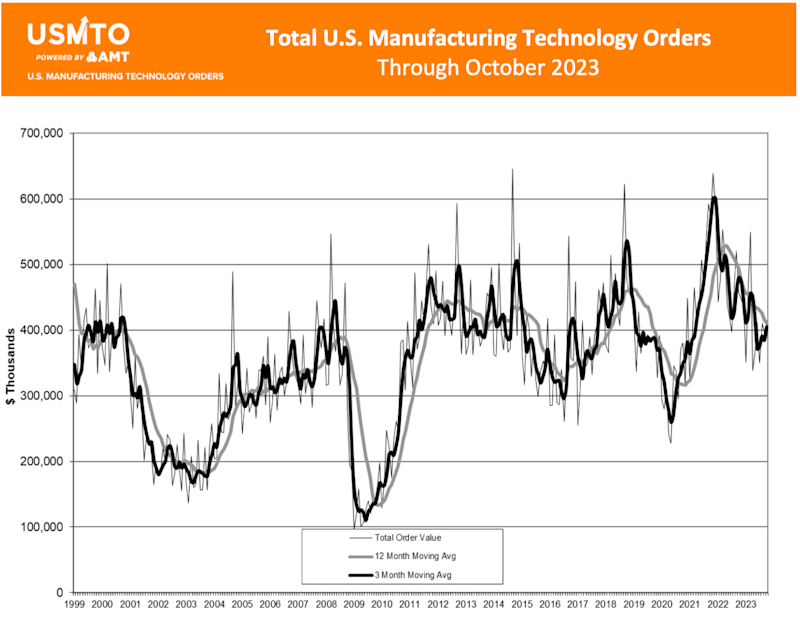

Despite a more optimistic outlook, orders for manufacturing technology, measured by the USMTO report, continued to fall relative to 2022. Through October 2023, orders totaled $4.05 billion, 13.5% behind the total for the first 10 months of 2022

As the summer of 2023 ended, the number of economists predicting a recession dwindled nearly as fast as the amount of sunlight each day. Despite the generally more optimistic outlook, orders for manufacturing technology, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology, continued to fall relative to 2022. Through October 2023 orders totaled $4.05 billion, 13.5% behind the total for the first 10 months of 2022.

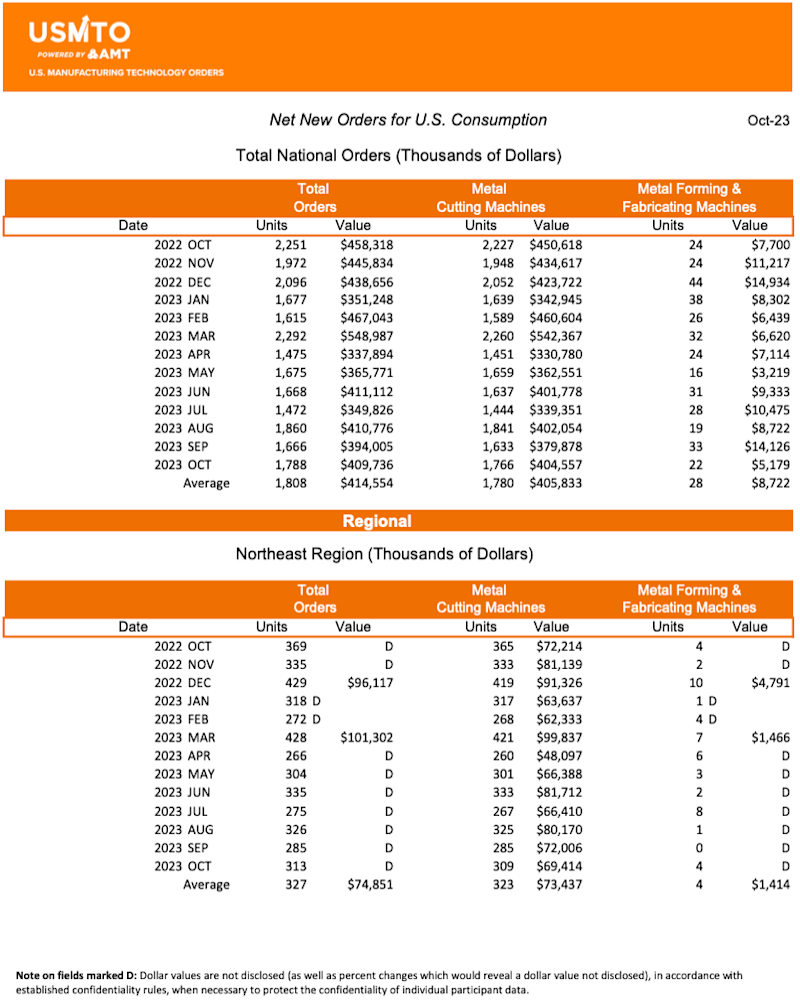

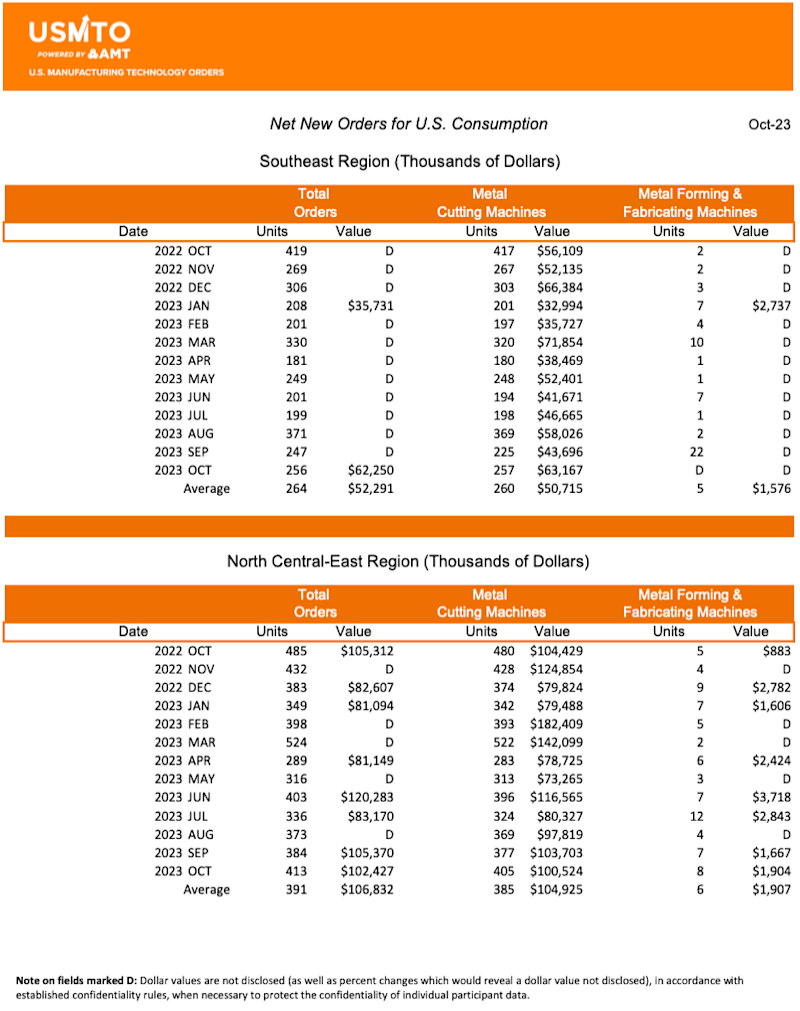

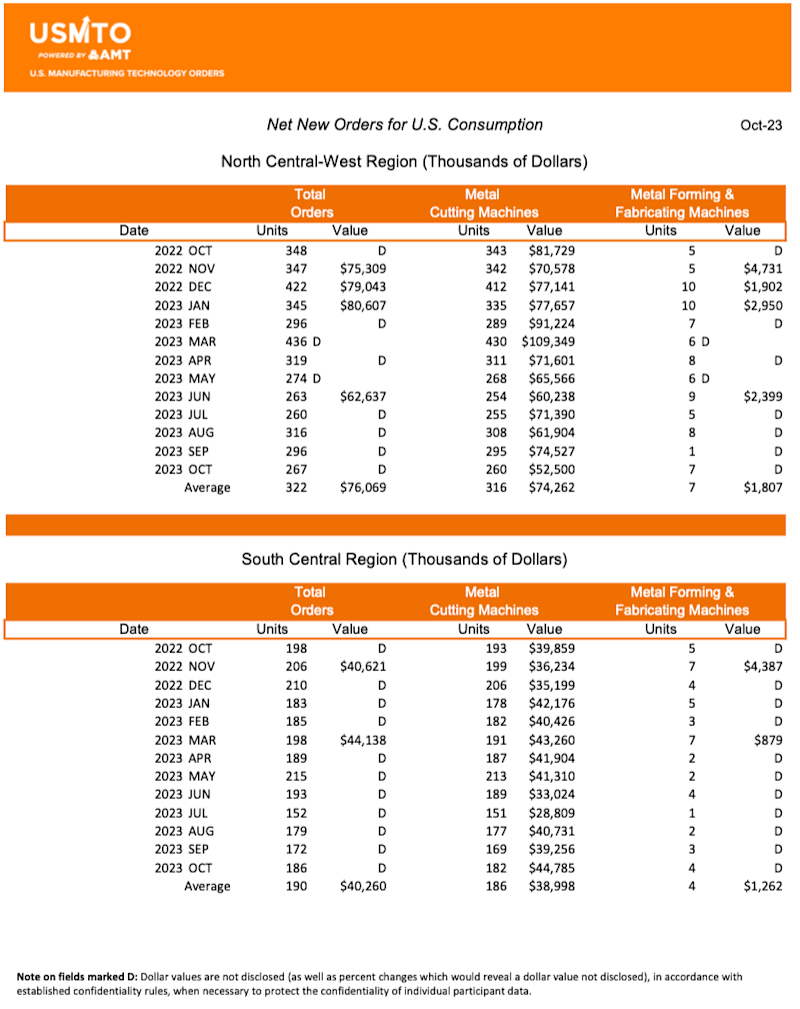

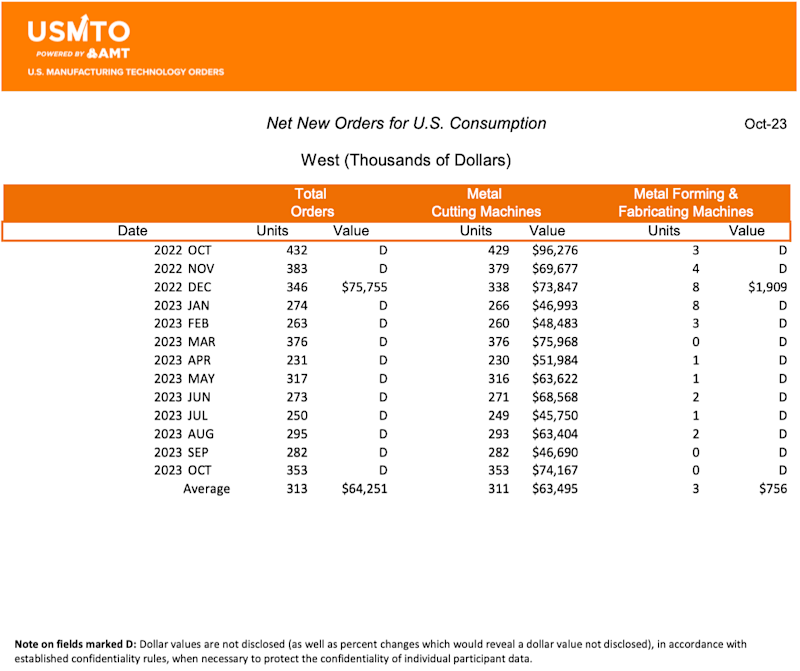

Although total orders were behind, October was slightly above the average monthly value in 2023. October orders totaled $409.7 million, 4% above September order values. This growth was driven by orders placed in the West region, which grew nearly 60% over September. The South Central and Southeast regions also saw growth but at a much more modest pace. The Northeast and North Central-East regions declined by modest single digits, while the North Central-West region declined nearly 30% from the value of September 2023 orders.

The six-week United Auto Worker’s strike lasted most of October, ending with a tentative agreement at the end of the month. Despite the shuttering of production lines, auto manufacturers continued to invest in manufacturing technology. Investments by automotive transmission manufacturers increased earlier in the year, but this is the second month in a row where manufacturers of other automotive components have increased investment.

Job shops decreased the value of their orders in October while increasing the number of units purchased. This indicates that job shops are purchasing machinery to increase capacity. In contrast, OEMs have been increasing order value at a faster pace than units, suggesting that they are purchasing machinery for a designated purpose. Of these OEMs, manufacturers of household and major appliance manufacturers made their largest investment since September 2018. Manufacturers of engines, turbines, and other power transmission equipment have continued their elevated pace of orders, already 8% above the amount invested in 2022. This sector is benefiting from recent government investment, pushing orders of manufacturing technology to levels not seen since the industry was transitioning from coal-fired plants to natural gas.

The November 2023 jobs report, published last Friday, came in slightly above expectations, with 199,000 new jobs added. This addition of jobs brought the unemployment rate down to 3.7% and demonstrated the continued strength of labor markets in the United States. Of those jobs added in November 2023, 28,000 were in the manufacturing sector. In addition to strong labor market conditions, consumer confidence improved for the first time in November following a three-month decline, according the Conference Board Consumer Confidence Index. A strong labor market and improving consumer confidence will have positivetrickle-down influence on the manufacturing technology markets.

The Federal Reserve meets on Wednesday for the final time in 2023. Although the recent cycle of interest rate increases has coincided with a decline in orders for manufacturing technology, this doesn’t align with historic trends. The Summary of Economic Projections from the meeting will be a critical gauge of where the Fed sees growth and inflation headed in the coming months and years. Further interest rate increases aren’t expected. However, even if rates remain elevated, manufacturing technology will continue to be needed in the future if consumers continue to demand goods and services.