January 2024 drops 15% with Planned Industrial Construction Projects in one month

Research by SalesLeads’ experienced industrial market research team, shows 369 new planned industrial projects tracked during the month of January. Planned industrial project activity decreased 15% from the previous month.

The following are selected highlights on new industrial construction news and project opportunities throughout North America.

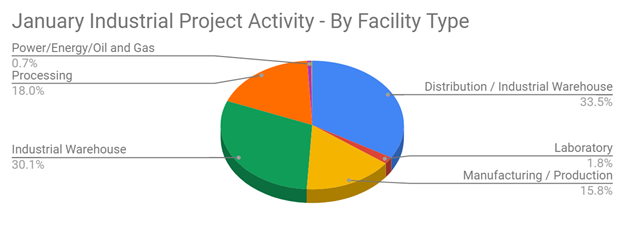

Planned Industrial Construction – By Project Type:

- Manufacturing Facilities – 90 New Projects

- Processing Facilities – 103 New Projects

- Distribution and Industrial Warehouse – 191 New Projects

- Power/Energy/Oil and Gas – 4 New Projects

- Laboratory Facilities – 10 New Projects

- Mine – 0 New Projects

- Terminal – 1 New Project

- Pipeline – 0 New Projects

Planned Industrial Construction – By Scope/Activity

- New Construction – 177 New Projects

- Expansion – 83 New Projects

- Renovations/Equipment Upgrades – 120 New Projects

- Plant Closing – 23 New Projects

Planned Industrial Construction – By Location (Top 10 States)

- Texas – 28

- Florida – 27

- New York- 23

- California – 22

- North Carolina – 19

- Indiana – 16

- Michigan – 16

- Ohio – 15

- Wisconsin – 13

- Georgia – 12

Largest Planned Industrial Construction Project

During January, our research team identified 30 new General Industrial facility construction projects with an estimated value of $100 million or more.

The largest project is owned by Pathways Alliance, which is planning to invest $17 billion in the construction of a carbon capture and storage facility in WOOD BUFFALO, AB. They are currently seeking approval for the project.

Top 10 Tracked Industrial Construction Projects

ONTARIO: Automotive MFR. is considering investing $14 billion for the construction of an EV battery manufacturing facility and currently seeking a site in ONTARIO.

ALBERTA: Oil and gas company is planning to invest $3 billion for the construction of a processing facility in WOOD BUFFALO, AB. They are currently seeking approval for the project. Construction will occur in two phases.

MISSISSIPPI: Energy technology company is planning to invest $2 billion for the construction of an EV battery manufacturing facility in MARSHALL COUNTY, MS. They are currently seeking approval for the project.

OKLAHOMA: Lithium producer is planning to invest $1.2 billion for the construction of a processing facility in MUSKOGEE, OK. They are currently seeking approval for the project. Construction is expected to start in Summer 2024.

TEXAS: Renewable energy company is planning to invest $1 billion for the construction of an ammonia processing facility in PORT ARTHUR, TX. They are currently seeking approval for the project.

NEBRASKA: Renewable energy company is planning to invest $650 million for the construction of an ammonia processing plant in AURORA, NE. They are currently seeking approval for the project. Construction is expected to start in early 2025, with completion slated for late 2026.

NORTH CAROLINA: Diesel engine MFR. is planning to invest $580 million for the expansion and equipment upgrades on their manufacturing facility in WHITAKERS, NC. They are currently seeking approval for the project.

ARKANSAS: Oil and gas service company is planning to invest $500 million for the construction of a bromine processing plant in COLUMBIA and LAFAYETTE COUNTIES, AR. They have recently received approval for the project.

ILLINOIS: Copper products MFR. is planning to invest $500 million for the expansion and equipment upgrades on their manufacturing facility in EAST ALTON, IL. They are currently seeking approval for the project.

CALIFORNIA: Semiconductor MFR. is planning to invest $432 million for the construction of a manufacturing facility in WEST OAKLAND, CA. They are currently seeking approval for the project.

About Industrial SalesLeads, Inc.

Since 1959, Industrial SalesLeads, based in Jacksonville, FL is a leader in delivering industrial capital project intelligence and prospecting services for sales and marketing teams to ensure a predictable and scalable pipeline. Our Industrial Market Intelligence identifies timely insights on companies planning significant capital investments such as new construction, expansion, relocation, equipment modernization, and plant closings in industrial facilities. The Outsourced Prospecting Services, an extension to your sales team, is designed to drive growth with qualified meetings and appointments for your internal sales team.