Achieving Zero Emissions in Construction and Agricultural equipment

Each segment of the transportation industry carries its own challenges in electrification, and some are easier to overcome than others. Personal automobiles, for example, have relatively few remaining challenges. Perhaps the biggest remaining issue for automobiles is the improvement of charging infrastructure to eliminate “range anxiety,” but there is no major technological barrier to solving this problem. Likewise, there are strong initiatives underway to address many of the medium- and heavy-duty vehicle segment challenges.

Off-road equipment, such as bulldozers and agricultural tractors, come with their own distinctive and more complex challenges to solve. These can include the technological issue of big machines needing a great deal of power to fulfill their tasks; the logistical challenge of charging off-road equipment in remote working locations; and the perception – the idea held by many that electrified off-road equipment is incapable of handling the work.

These challenges may not be easy to solve, but they are not insurmountable. With forward-looking and unique applications of technology, legislation, and education, these problems can be assessed and eliminated.

CALSTART – a non-profit working to build a prosperous, efficient, and clean high-tech transportation industry – has commissioned a research project on zero-emission off-road equipment and the challenges faced in deploying it. A preliminary look into the report’s findings related to construction and agricultural off-road equipment is presented here, prior to the report’s full release.

Electrification of Construction Equipment is Moving Forward

According to CALSTART’s report, construction equipment electrification is both more achievable and desirable than agricultural equipment electrification. The reason is that it is simply easier to electrify construction equipment compared to other types of off-road vehicles. This is because most construction happens in cities, so there is less of a challenge in accessing infrastructure than with more remote off-road applications. Additionally, construction equipment is often compact compared to other off-road categories, and so the possibilities for immediate electrification using current technology are strong. There is also the added benefit of noise reduction – a significant issue in urban areas, where most construction equipment is used. In contrast, agricultural vehicles typically operate in more rural areas, where noise pollution is not always a major concern.

Construction equipment market projections

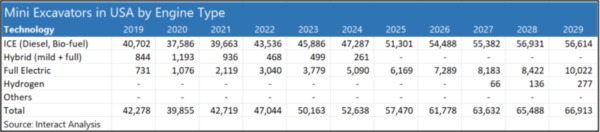

There is already clear evidence of progress in some areas of the construction equipment market. In the U.S.-centric example below, small excavators have made significant inroads, and have the largest market increase of all clean engine types. Fully electric small excavators made up 5% of the U.S. market in 2021, and this is expected to rise to 15% by 2029.

However, while encouraging, the U.S. market penetration of this equipment is limited compared to that of other countries.

Unique Challenges Facing Electrification of Agricultural Equipment

Although agricultural off-road equipment accounts for only a small percentage of the harmful emissions created by the industry overall, reduction of GHG emissions wherever possible can only help to reduce air pollution and climate change effects. Internal combustion of agricultural equipment not only releases emissions harmful to humans but to the surrounding plant and wildlife in the areas in which agricultural equipment is used. (Noise pollution reduction is also appreciated by wildlife.)

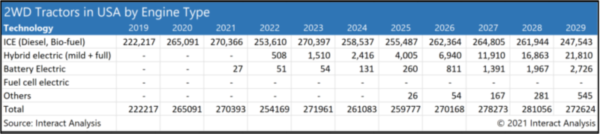

There are significant and multiple benefits to electrifying agricultural equipment, and there is some success already. The CALSTART report indicates that two-wheel-drive tractor sales are growing fast, with 2,726 new units projected to hit the market in 2029. Hybrid electric is also doing well (see table below).

Additionally, in California, there are several electric tractor manufacturers (such as Solectrac and Monarch) producing electrified agricultural equipment to meet the needs of some of the state’s specialized agrarian pursuits, among them California’s famous vineyards and orchards.

Forklifts – Early Adopters

Forklift manufacturers and operators were early adopters of electrified equipment; this was largely due to the fact that forklifts often operate indoors, where workers are constantly exposed to diesel fuel emissions.

Even with forklift operators embracing electric vehicles early on, internal combustion forklifts still represent a significant portion of forklift sales (33% in 2021). As regulations become more stringent, this is changing; in California, for example, a ban on the sale of all new internal combustion forklifts is expected beginning in 2025.

Regulations and legislation are not the only drivers of increasing electric forklift sales. The rapidly increasing efficiency of the batteries used to power them is having a growing positive effect on sales. Lithium-ion batteries charge quickly and are very efficient, especially when compared to the less-desirable lead-acid battery. Current projections show that lithium-ion batteries will make up more than 60% of the total electrified forklift market by 2029. Electrified forklifts are also proving the efficiency of hydrogen fuel cell technology, with over 10,000 units expected to ship in 2029.

The Challenges Facing Construction and Agricultural Equipment

Of course, forklifts are only one example of off-road equipment; there are still serious challenges to achieving this same success with agricultural and construction equipment.

One of these challenges is perception. Many stakeholders across these industries assume that an electrically powered machine will not be able to perform to the level of their internal combustion counterparts – even when it has been shown that those electric vehicles can indeed do so. There is also the concern that charging these vehicles out in the remote regions in which they operate will be a problem. This concern is not limited to agricultural equipment; construction equipment, usually located in urban or suburban locales, can also face charging challenges since construction sites are often cramped and difficult to navigate.

Finally, although battery technology is, as pointed out above, continually and rapidly improving, the problem of duty cycles is a big consideration. Both agricultural and construction equipment often sit idle for long periods and then can be suddenly called upon to operate intensively for many hours. The batteries that power these vehicles must be able to endure these long downtimes and still have sufficient charge left to accomplish the work their internal combustion counterparts are called upon to do, without needing to recharge during the workday.

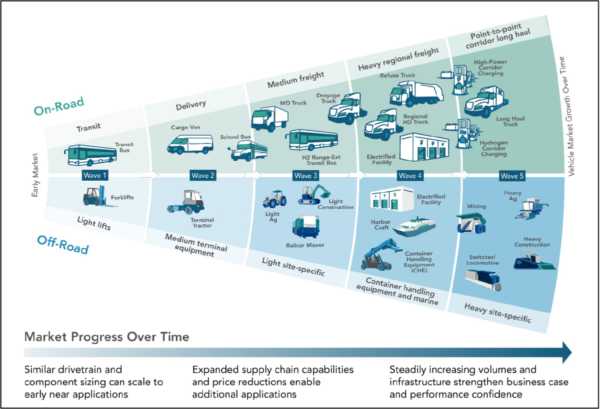

Solving These Challenges With the Beachhead Model

The challenges of electrifying heavy off-road equipment are not insurmountable. One of the better ways to identify and solve these problems is the “beachhead model,” conceptualized by CALSTART and the California Air Resources Board (CARB). The beachhead approach focuses early attention on smaller electrified machinery and equipment; then, as the battery, component technology, and supply chain advances are made, they are upscaled and incorporated into increasingly larger equipment (see figure below). The beachhead strategy has already proven successful in addressing the challenges and eliminating the barriers to electrifying the off-road equipment arena.

Suggesting that heavy off-road equipment can be fully zero-emission may seem ambitious, and it is impossible to predict with certainty exactly what the technology path toward zero emissions for the heaviest off-road equipment will be. Yet advances are being made rapidly. Equipment such as Volvo Construction Equipment’s five-ton electrified wheel loader with a run time of up to six hours would have been inconceivable until recently. Even just three years ago, almost no off-road OEM had any electric equipment options; now they nearly all have one or more options. What is certain is that R&D in developing smaller zero-emission vehicles will cause advances that will ultimately make larger zero-emission vehicles possible, too.

About the Author:

Stay tuned for the release of our full report on zero-emission off-road equipment in August. In the meantime, to learn more about the beachhead model, check out the CALSTART beachhead model white paper. If you would like to know more about off-road equipment electrification, please contact [email protected].

The beachhead model from CALSTART and CARB shows how progress made in decarbonizing small equipment will lead to advances in the decarbonization of larger equipment, as well.