US Cutting Tool Orders totaled $212.4 Million in March 2024, bringing the Year-to-Date total up 2% from 2023

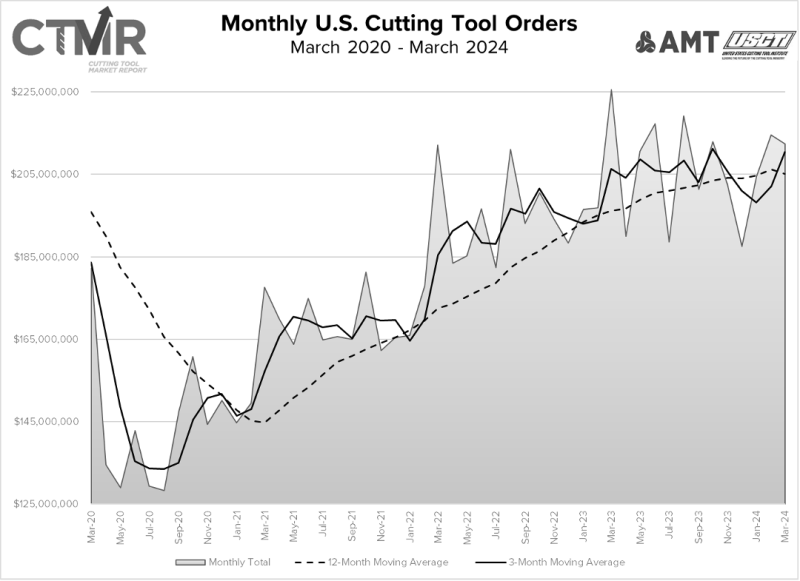

March 2024 U.S. cutting tool consumption totaled $212.4 million, according to the U.S. Cutting Tool Institute (USCTI) and AMT – The Association For Manufacturing Technology. As reported by companies participating in the Cutting Tool Market Report collaboration, this total was down 1.1% from February’s $214.6 million and down 5.8% compared with the $225.6 million reported for March 2023. With a year-to-date total of $631.5 million, 2024 is up 2% compared to the same period in 2023.

Jack Burley

“Despite the troubles at Boeing, cutting tool shipments to aerospace and defense-related manufacturing remain quite strong,” declared Jack Burley, chairman of AMT’s Cutting Tool Product Group. “First quarter data indicates that consumption of cutting tools and tooling remains on pace with current industrial production at a modest level. This may be an indicator of somewhat sluggish activity.

“New projects are available in most industries, but many customers are reluctant to move forward, possibly because they are worried about inflation and election results. Despite the downward trend in new machine tool orders, I find it very interesting that cutting tools and related accessories to keep shops running are still performing reasonably well.”

Steve Stokey, executive vice president and owner of Allied Machine and Engineering, agreed that inflation remained an industry concern.

Steve Stokey

“The first quarter of 2024 is up slightly over the first quarter of 2023, but the long-run trend has turned negative for the first time since March 2021, when the industry began to recover from the COVID-19 downturn,” Stokey said. “Stubbornly high inflation appears to be a drag on the industry as the number of units shipped has shown a more sluggish trend than the value of shipments. If these patterns continue, the remainder of the year could end flat or slightly down from 2023.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology.

The graph below includes the 12-month moving average for the durable goods shipments and cutting tool orders. These values are calculated by taking the average of the most recent 12 months and plotting them over time.