Key takeaways from the fourth quarter Plastics machinery shipment

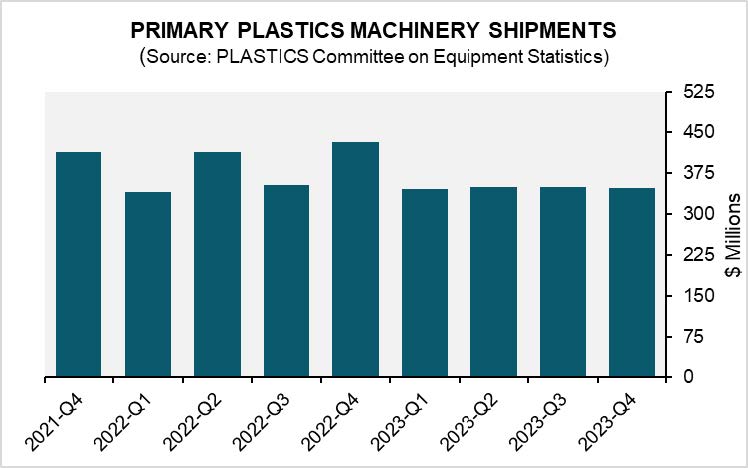

The Plastics Industry Association’s Committee on Equipment Statistics (CES) has unveiled the fourth-quarter shipment data for primary plastics machinery, covering injection molding and extrusion activities in North America. Initial estimates for Q4 2023 indicate a shipment value of $348.1 million, reflecting a 0.4% decrease from the revised figure of $349.6 million in the preceding quarter. When compared to the same period in the previous year, the value of shipments shows a notable 19.5% decrease.

In the domain of primary plastics machinery, single-screw extruders experienced a notable 19.5% decrease in quarter-over-quarter (Q/Q) analysis but showed a 4.9% increase year-over-year (Y/Y). Twin-screw extruders also witnessed a comparable decrease of 19.4% Q/Q and a more substantial 23.8% decrease Y/Y. Conversely, injection molding shipments increased by 3.8% Q/Q but faced a 21.1% decrease Y/Y.

Dr. Perc Pineda

“Last year saw minimal fluctuations in quarterly plastics machinery shipments. The modest upturn observed in the second quarter was short-lived, with shipments remaining steady until the year’s end,” noted Perc Pineda, Chief Economist at PLASTICS. “The decline in U.S. manufacturing activity, coupled with a high-interest-rate environment, contributed to a slowdown in business investment spending, including in plastics machinery,” Pineda added.

In the latest quarterly survey by CES polling plastics machinery suppliers for market insights and equipment expectations, results showed a notable uptick in participants anticipating improved market conditions over the next twelve months compared to the previous year. The percentage of those expecting conditions to either remain the same or improve rose to 82.9%, signaling optimism compared to the 56.1% recorded in the prior quarter.

As 2023 concluded, U.S. exports of plastics equipment saw a 5.1% increase in the fourth quarter, reaching $284.6 million from the previous quarter. Year-over-year exports surged by 19.6%. Mexico and Canada maintained their positions as the top export markets for U.S. plastics equipment, accounting for a combined export share of 62.3%. Half of these exports, totaling $124.3 million, were directed to Mexico, while less than a fifth (18.6%) to total exports went to Canada, totaling $53.0 million. Meanwhile, imports experienced an 11.7% quarter-over-quarter increase, reaching $427.6 million, but faced a 14.1% year-over-year decrease.

“While the unexpected 2.5% U.S. economic growth in 2023 averted a recession, primarily fueled by robust household spending in the services sector, signs of recovery may emerge in 2024. Sustained consumer spending could prevent economic deterioration, especially if labor markets continue to stay healthy. As interest rates begin to return to normalcy from inversion, there’s a likelihood that business investment, including in equipment, will reverse course,” remarked Pineda.